Hold onto your hats, crypto fans! Last week, a trader got absolutely REKT in a DeFi deal gone wrong, losing a whopping $215,000 in a single transaction. It's all thanks to something called a "sandwich attack," and it's got everyone in the crypto meme coin world talking.

Ouch! This is the image that's going viral in the crypto space.

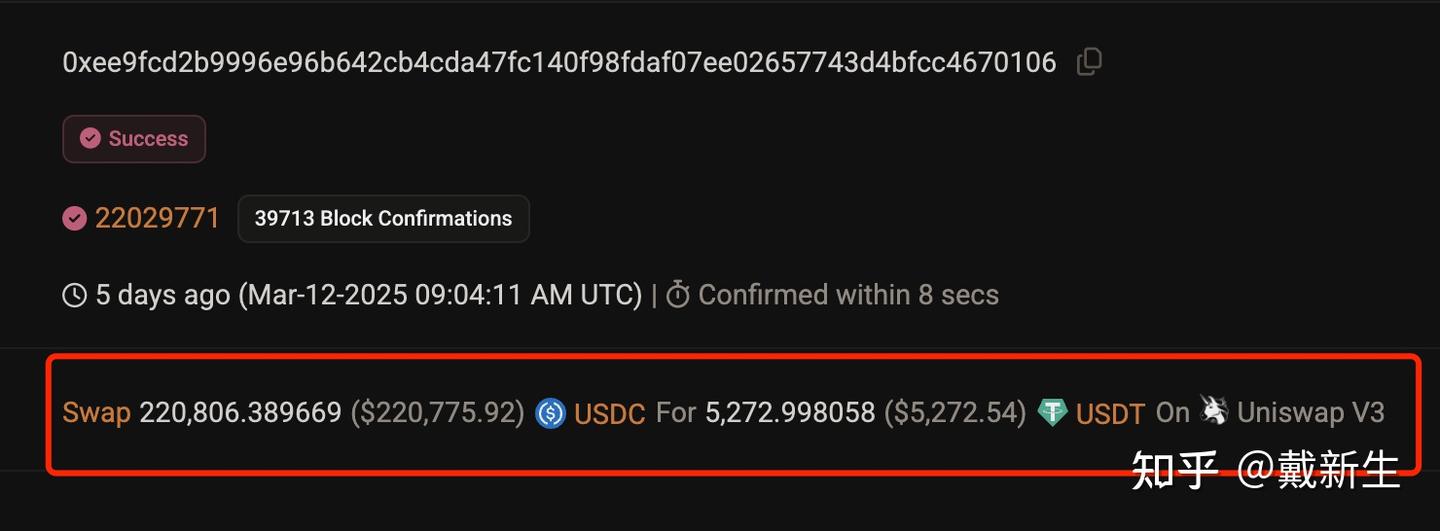

Here's the juicy scoop: This unlucky user was trying to swap $220,800 of USDC (a stablecoin pegged to the US dollar) for USDT (another stablecoin) on Uniswap v3. Sounds simple, right? Wrong! Instead of getting roughly the same value back, they only received a measly $5,272 USDT. Poof! $215,000 vanished in seconds. Check out the horror in the transaction record:

The painful transaction details on the blockchain. Source: Etherscan

This isn't just bad luck; it's a textbook example of a sandwich attack, a nasty trick in the crypto world that you need to know about, especially if you're playing around with meme coins on decentralized exchanges (DEXs) like Uniswap.

A simplified visual of a sandwich attack. Imagine your trade getting squeezed!

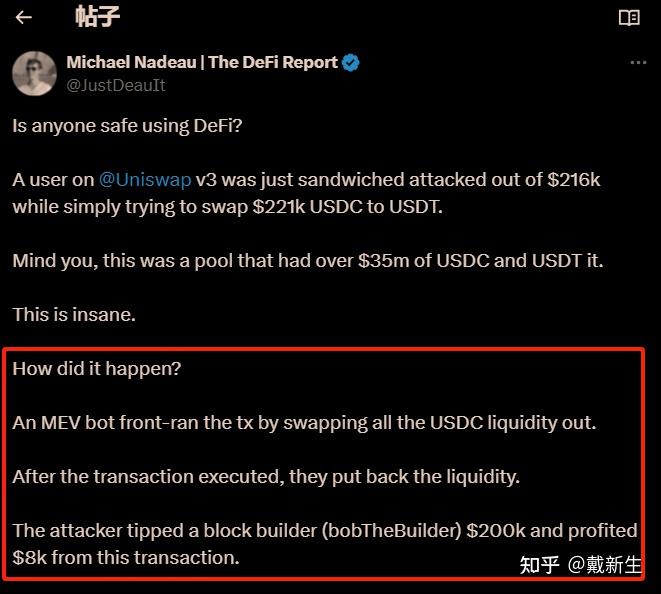

Crypto expert Michael (JustDeauIt on X) was the first to point out this attack, explaining that a sneaky MEV bot was behind it. MEV stands for "Maximal Extractable Value," and these bots are always on the prowl to make extra profit, sometimes at your expense.

Michael explained it like this:

An MEV bot front-ran the tx by swapping all the USDC liquidity out. After the transaction executed, they put back the liquidity.

In plain English: The MEV bot jumped in before the trader's transaction went through. It quickly bought up a bunch of USDT, pushing the price up. Then, when the trader's big USDC swap finally executed, they got a terrible exchange rate because the price had been artificially inflated. After profiting from the trader's slippage, the bot then put the liquidity back, leaving the victim holding the bag. And get this – the attacker even tipped off the "block builder" (think of them as blockchain transaction organizers) with a massive $200,000 bribe to make sure their malicious transactions went through first! They profited about $8,000 from the attack itself on top of that.

Confused? Don't worry, it sounds complicated, but let's break it down. You've probably heard terms like "sandwich attack," "front-running," "liquidity," and "block builder" thrown around. Let's get you up to speed so you can protect yourself.

WTF is MEV Anyway?

MEV used to be called "Miner Extractable Value" back in the old days of crypto mining. Now, with fancy upgrades like Ethereum's move to Proof-of-Stake, it's more accurately called "Maximal Extractable Value." Basically, it's about who gets to decide the order of transactions on the blockchain, and how they can use that power to make extra cash.

Think of it like this: imagine you're at a busy coffee shop and you want to cut in line. If you're the barista (the "miner" or "validator" in crypto terms), you can choose to put your friend's order (the MEV bot's transaction) ahead of everyone else's. This "cutting in line" in crypto can let someone manipulate prices and skim profits.

So, MEV exists because the people who organize transactions into blocks (validators) have the power to order them. Every block on Ethereum gets processed roughly every 11 seconds, which means these MEV opportunities pop up all the time. And guess what? This recent $215K sandwich attack? Yep, it was made possible by validators ordering transactions in a specific way.

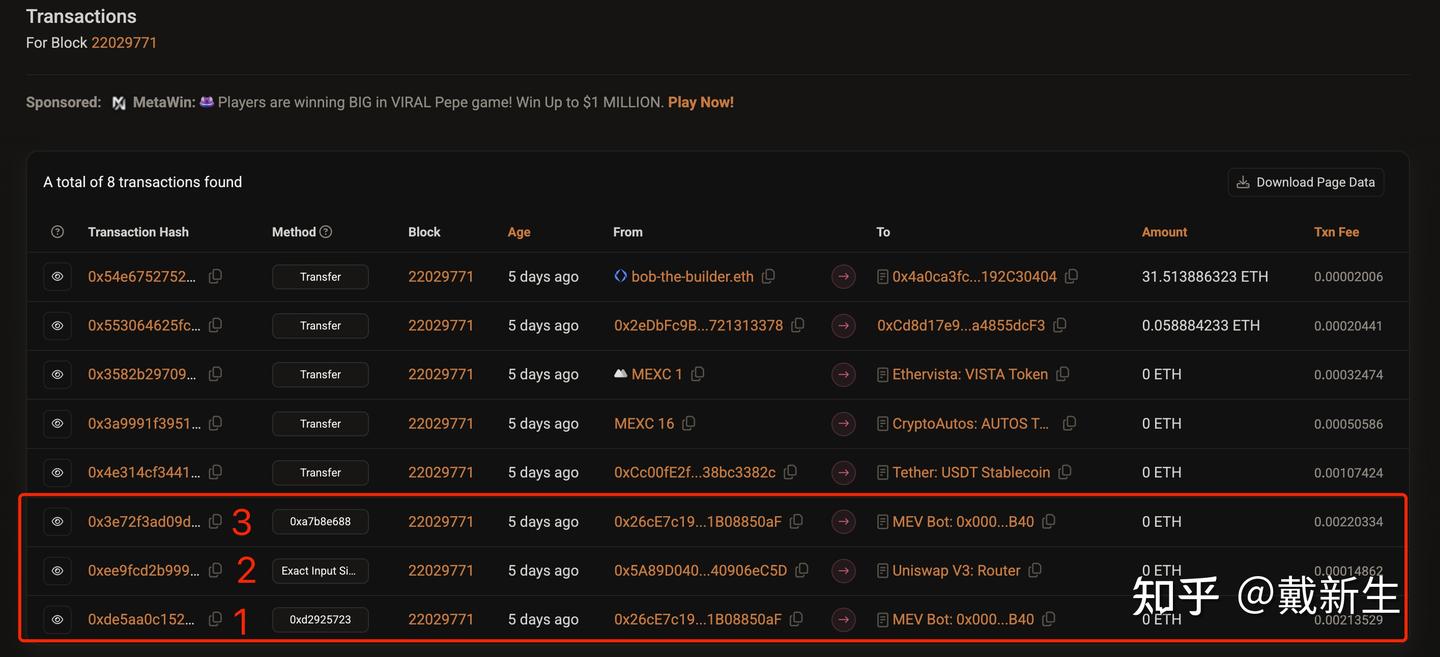

Wanna see the blockchain proof? Check out this link to block number 22029771 on Etherscan. This block contains the transactions from the attack.

Block 22029771 on Etherscan – see the attack transactions (numbered 1, 2, and 3) in the order the validator put them.

See those transactions labeled 1, 2, and 3? That's the sandwich attack in action, all neatly ordered by the validator (bobTheBuilder in this case). But how does this ordering power lead to attacks?

Blockchain Basics: How It Works (Simplified!)

To understand MEV attacks, you need a tiny bit of blockchain 101. Think of the blockchain as a giant, ever-growing record book. It tracks every crypto transaction. The "state" of the blockchain is just a snapshot of everything at a given time – account balances, how much of each token is in a Uniswap pool, etc.

When you make a trade on Uniswap, your transaction goes into a waiting area called the mempool. Imagine it as a digital waiting room for transactions. Validators (the new miners) pick transactions from this mempool and bundle them into blocks, adding them to the blockchain.

Here's the key: Validators get to decide which transactions to include in a block and, crucially, in what order. This is where MEV comes in. If someone can influence this order, they can manipulate things for profit.

Think of the block creation process like this:

- Transactions pending: Your trade and everyone else's trades are chilling in the mempool, waiting to be processed.

- Validator picks transactions: A validator (like bobTheBuilder in our example) selects a bunch of transactions from the mempool to put in the next block.

- Validator orders transactions: This is the crucial step. The validator decides the order of transactions within the block.

- Block added to blockchain: The block of ordered transactions gets added to the permanent blockchain record, and everyone's balances and trades update accordingly.

Because validators control transaction ordering, MEV bots can bribe them or use other tricks to get their transactions processed at just the right moment, like right before or right after a big, unsuspecting trade. And that's exactly how sandwich attacks happen!

This is for informational purposes only and not financial advice. Meme coins are risky, and DeFi adds another layer of complexity. Always do your own research and be careful out there!