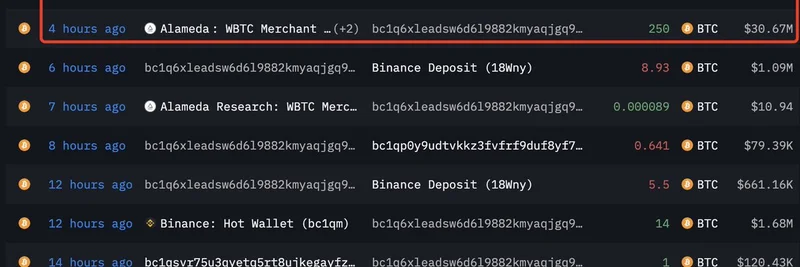

If you've been keeping an eye on the crypto world, you know that big moves by major players can send ripples through the market. Recently, on-chain data tracker Lookonchain spotted something intriguing: Alameda Research, the infamous trading firm tied to the collapsed FTX exchange, deposited 250 Bitcoin—worth about $30.6 million—to Binance just a few hours ago.

This transaction was highlighted in a tweet from Lookonchain, linking to the address

- No primary headings should be used in the main text to avoid duplicate h1 tags.

explorer on Arkham Intelligence: bc1q6xleadsw6d6l9882kmyaqjgq9nl63npnftd388. For those new to this, on-chain analysis involves tracking transactions directly on the blockchain, giving us a transparent view of fund movements without relying on rumors.

Why This Matters

Alameda Research isn't just any entity—it's the quantitative trading firm founded by Sam Bankman-Fried, which played a central role in the FTX debacle back in 2022. After FTX's collapse, Alameda's assets have been under scrutiny as part of bankruptcy proceedings and asset recovery efforts. Deposits like this to a major exchange like Binance often spark speculation: Is this a sign of selling pressure? Or perhaps just routine asset management?

In the broader context, Bitcoin's price has been volatile, and large transfers can influence market sentiment. At the time of the deposit, BTC was hovering around levels that make a $30 million move noteworthy but not earth-shattering. However, for meme token enthusiasts and blockchain practitioners, this serves as a reminder of how interconnected the crypto ecosystem is. Meme coins often ride the waves of major assets like BTC, so any potential sell-off could trickle down to affect volatility in smaller tokens.

Breaking Down the Transaction

From the on-chain data, this isn't an isolated event. The address shows a pattern of inflows and outflows involving Alameda-labeled wallets and Binance deposits. For instance:

- 3 hours ago: 250 BTC from an Alameda merchant wallet to Binance.

- Similar smaller transfers in the preceding hours.

This could be part of liquidating remaining assets or repositioning funds. Binance, as one of the largest exchanges, is a common destination for such moves due to its liquidity.

Implications for Meme Tokens and Beyond

While this is primarily a Bitcoin story, at Meme Insider, we always look at how traditional crypto events impact the meme space. If Alameda is indeed offloading BTC, it might increase selling pressure, potentially leading to a dip that meme tokens—known for their high beta to BTC—could amplify. On the flip side, if this is just housekeeping, it might not move the needle much.

For those building in blockchain, tools like Arkham Intelligence are goldmines for staying ahead. They help demystify whale movements, which can inform trading strategies or even inspire new meme narratives around "ghosts of FTX past."

Keep an eye on the markets, and remember: In crypto, transparency via on-chain data is your best friend. If you're diving deeper into meme tokens influenced by these events, check out our knowledge base for more insights.