Hey there, crypto enthusiasts! If you're keeping tabs on the Ethereum ecosystem, you've probably heard the buzz around Arbitrum. Recently, Token Terminal, the go-to platform for crypto fundamentals, spotlighted a fantastic data-driven report from Alea Research on X (formerly Twitter). They nailed it when they said, "Blockchains are Internet-native economies. Chain GDP matters." Let's break down what this means and why Arbitrum is turning heads.

Arbitrum's Rise to the Top

Arbitrum launched back in 2021 and didn't waste any time climbing the ranks among Ethereum Layer 2 (L2) solutions. For the uninitiated, L2s are scaling technologies built on top of Ethereum to make transactions faster and cheaper while inheriting its security. Today, Arbitrum leads in key metrics like total value locked (TVL)—that's the amount of assets secured on the chain, sitting at around $19 billion according to L2Beat. It also dominates in perpetual futures (perps) trading volume and fees generated.

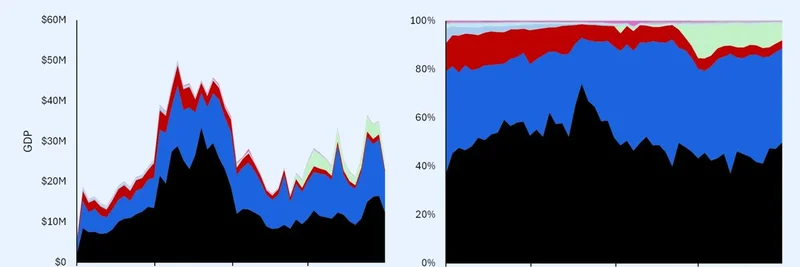

This chart from Alea Research illustrates how Arbitrum's "Chain GDP"—essentially the economic output of the blockchain, measured by fees and other revenues—is going toe-to-toe with Base, another hot L2 contender. It's a stacked view of various chains' contributions over time, highlighting the competitive landscape.

Profitability in a Crowded Field

Out of countless blockchains, only 14 are actually profitable, meaning they bring in more revenue than they spend on operations. Arbitrum One ranks fourth overall and second among L2s. Since Base doesn't have a liquid token yet, $ARB stands out as a prime way for investors to bet on the L2 sector's growth.

Right now, all revenue flows straight to the Arbitrum DAO treasury, which is governed by $ARB holders. Burning tokens (permanently removing them from circulation to potentially increase value) isn't on the table yet, as it would dip into funds used for grants and incentives. This setup keeps Arbitrum competitive, offering flexibility in a fast-evolving space.

Beyond the Basics: Arbitrum's Product Suite

Arbitrum isn't just resting on its L2 laurels. They've got a lineup of innovative products:

- Orbit: Allows for free Layer 3 (L3) chains, which are even more specialized scaling solutions built on L2s.

- Stylus: A multi-VM engine supporting WebAssembly (WASM) alongside the Ethereum Virtual Machine (EVM), making it easier for developers to build in different languages.

- BoLD (Bounded Liquidity Delay): Enhances liquidity management.

- TimeBoost: A sealed-bid auction for block priority, optimizing transaction ordering.

- Arbitrum Nova: An AnyTrust chain for data availability, balancing cost and security.

These features differentiate Arbitrum from competitors like Optimism. Plus, the Arbitrum DAO actively manages its treasury for yields and investments, unlike more passive approaches elsewhere.

Market Dynamics and Future Outlook

Recent market moves show $ARB and $OP (Optimism's token) turnover dipping from highs above 10% to around 5%, possibly due to Ethereum's strong performance. But Alea Research sees $ARB as more than just an ETH beta play—it's like a cash-flow option with profits building up in the DAO treasury.

If you're intrigued, Alea Research's full thesis dives deeper into the core $ARB investment case, L2 competition, risks, and more. It's premium content, but you can check out their free resources or join for access. For the original thread, head over to Alea Research's X post.

Arbitrum's story is a prime example of how L2s are evolving into robust economic engines. Whether you're a developer, investor, or just curious about blockchain tech, keeping an eye on Chain GDP could be key to spotting the next big winners. What do you think— is Arbitrum poised to dominate? Drop your thoughts in the comments!