Ever scrolled through X (formerly Twitter) and stumbled upon a post that makes you rethink the entire asset landscape? That's exactly what happened with this recent tweet from @0xkyle__, highlighting a mind-blowing fact: the art, cars, and collectibles market is actually larger than gold. Yeah, you read that right—$27 trillion versus gold's $22 trillion. And within that massive collectibles space, trading cards alone account for an estimated $7 billion.

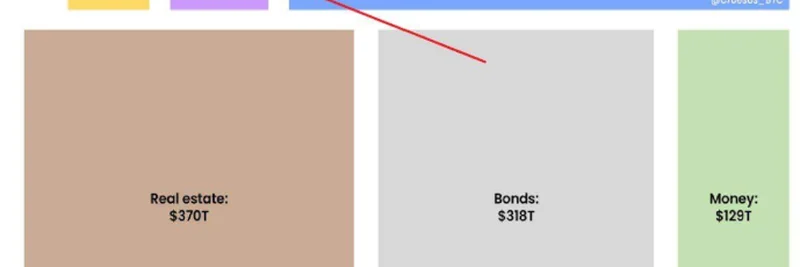

The chart in the tweet paints a vivid picture of the global asset pie, totaling around $1,000 trillion. Bitcoin sits at a modest $2 trillion, dwarfed by giants like real estate at $370 trillion and bonds at $318 trillion. But the real eye-opener is how art, cars, and collectibles sneak in at $27 trillion, edging out gold. This isn't just trivia; it's a signal for where value is shifting in our increasingly digital world.

Why Collectibles Are Booming

Collectibles have always been about more than just owning stuff—they're about stories, rarity, and community. Think Pokémon cards or vintage cars; these items hold sentimental and speculative value. The tweet points out that trading cards make up a chunky $7 billion of this market, which got us thinking about parallels in the crypto space. Meme tokens, often dismissed as jokes, function similarly: they're digital collectibles fueled by hype, memes, and FOMO (fear of missing out).

In blockchain terms, this liquidity in traditional collectibles could supercharge when tokenized. Imagine fractional ownership of a rare art piece or a classic car via NFTs (non-fungible tokens). Crypto is already making waves here, turning illiquid assets into tradeable ones on platforms like OpenSea or Solana-based meme token launchpads.

Tying It Back to Meme Tokens

Meme tokens thrive on virality, much like how a hot trading card set can skyrocket in value. Projects like Dogecoin or newer ones on Pump.fun show how community-driven assets can capture billions in market cap overnight. The tweet's thesis, as echoed in replies, seems to hint at crypto's role in making collectibles more liquid. One user asked: "crypto making this category more liquid?" Spot on—blockchain reduces barriers, enabling 24/7 trading without physical storage hassles.

For blockchain practitioners, this is a call to action. If traditional collectibles are worth $27 trillion, the digital meme economy could explode as adoption grows. We're seeing this with meme coins integrating utility, like governance or staking, blending fun with finance.

Future Outlook

As the lines blur between traditional and digital assets, meme tokens could bridge the gap. Keep an eye on trends like real-world asset (RWA) tokenization, where physical collectibles get a blockchain makeover. This could democratize access, letting anyone own a slice of a Picasso or a Ferrari via a token.

If you're diving into meme tokens, remember: research the community, check the tokenomics, and never invest more than you can afford to lose. The collectibles market's size shows there's real value in what seems niche—crypto is just amplifying it.

What do you think? Is the next big meme token going to rival trading cards in value? Drop your thoughts in the comments below!