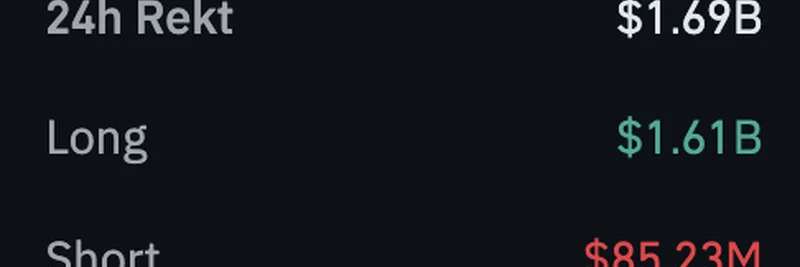

In the wild world of crypto trading, few things get the blood pumping like a massive liquidation event. On September 22, 2025, X user @martypartymusic dropped a bombshell tweet highlighting a staggering $1.69 billion in liquidations across the market, dubbing it the "Binance Royal Flush." This poker-inspired term perfectly captures the high-stakes drama, where overleveraged positions get wiped out in a flash.

For those new to the scene, liquidations occur when traders use leverage—essentially borrowing money to amplify their bets—and the market moves against them. If prices drop too far for long positions (betting on price increases) or rise for shorts (betting on decreases), exchanges like Binance automatically close these trades to prevent further losses. In this case, the data shows longs taking the biggest hit at $1.61 billion, suggesting a sharp downward price swing caught many bulls off guard. Shorts, meanwhile, saw $85.23 million flushed out, but it was the longs who really felt the pain.

This event isn't just numbers on a screen; it's a wake-up call for meme coin enthusiasts. Meme tokens, known for their viral hype and extreme volatility, often attract heavy leverage from retail traders chasing quick gains. Projects like Dogecoin or newer entrants on Solana and Base chains can skyrocket or plummet overnight, making them prime targets for such shakeouts. As @martypartymusic pointed out, this "royal flush" on Binance likely cleared out weak hands, potentially setting the stage for a more stable rebound.

Replies to the tweet echoed the chaos, with users like @Qadir_76 noting that BNB barely budged amid the turmoil, and @Piggyfruits linking it to recent comments from Binance's former CEO CZ about dumps being healthy for finding market bottoms. Others, like @SeanLee84, saw it as a buying opportunity, scooping up ETH and BTC on the dip. It's a classic crypto sentiment: pain for some, gains for others.

For blockchain practitioners diving into meme tokens, events like this underscore the importance of risk management. Avoid overleveraging, set stop-losses, and remember that meme coins thrive on community and narrative, not just charts. If you're building or trading in this space, tools like Coinglass for real-time liquidation data can be invaluable. Stay vigilant—Meme Insider is here to keep you ahead of the next flush.

Why This Matters for Meme Tokens

Meme coins often lead the pack in volatility during market corrections. With billions in liquidity tied to leveraged positions, a single tweet or macro event can trigger cascades like this one. Traders got rekt, but it also resets the board, potentially opening doors for fresh pumps in resilient projects.

Lessons from the Flush

- Diversify Your Bets: Don't go all-in on one meme; spread across established ones like SHIB and emerging gems.

- Monitor Leverage Ratios: High liquidation volumes signal overextended markets—use this as a contrarian indicator.

- Community Strength: Memes with strong holders weather storms better. Check X threads for sentiment shifts.

As the crypto landscape evolves, keeping tabs on these high-impact moments helps you level up. Follow Meme Insider for more breakdowns on meme token news and strategies.