In the fast-paced crypto world, whale watching is more than a hobby—it's a way to gauge market sentiment. Recently, a Bitcoin OG (that's "original gangster," slang for an early adopter who's been in the game since the beginning) made some intriguing moves that caught the eye of on-chain analysts. According to a thread from Onchain Lens on X, this whale partially closed a hefty 10x leveraged short position on BTC, locking in a cool $2.39 million in profits.

For those new to the lingo, a short position means betting that the price of an asset will drop. With 10x leverage, you're amplifying your potential gains (or losses) by borrowing funds—essentially playing with fire if the market turns against you. This OG had been holding a short worth around 2,100 BTC, valued at $227 million, with a floating profit of $5.8 million just a day earlier. By partially closing, they reduced the position to 1,300 BTC (about $141.5 million), still sitting on a $3 million unrealized gain.

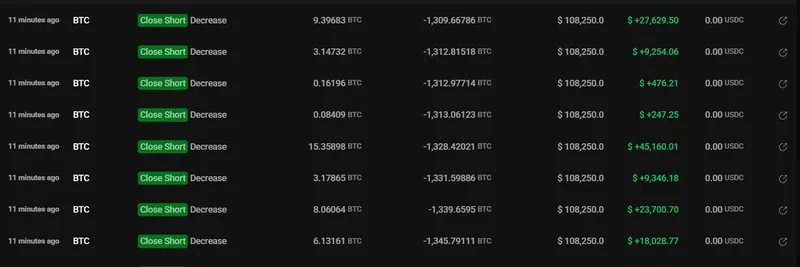

The screenshot above, shared in the thread, details the series of "Close Short" trades executed in quick succession, each chipping away at the position and realizing incremental profits ranging from hundreds to over $124,000 per trade.

Connecting the Dots with Previous Activity

This isn't the first time this whale has made waves. Just the day before, they deposited a whopping 3,003 BTC—worth $338.15 million at the time—into Binance, one of the largest crypto exchanges. On-chain data from tools like Arkham Intelligence tracks these movements, showing how large holders shift assets between wallets and platforms.

In this latest update, the OG also moved 100.1 BTC, valued at $10.81 million, to Kraken, another major exchange known for its liquidity and trading features. Deposits like these often spark speculation: Are they preparing to sell, or just repositioning for the next play?

The transfer log highlights the outflow to Kraken, part of a series of movements that suggest active management of their portfolio.

Current Position and Market Implications

Peeking at the trader's profile on Hyperbot, the remaining short position shows a mark price around $108,837, with the entry at $111,190—explaining the positive unrealized PnL (profit and loss). The total position value sits at over $141 million, with a 39.93% margin used ratio, indicating they're still committed but not overextended.

Why does this matter? In crypto, whale actions can influence price swings. A big short like this might signal bearish views, potentially pressuring BTC's price downward. But partial closures could mean taking profits off the table while keeping skin in the game, perhaps anticipating a short-term dip before a rebound.

How This Ties into Meme Tokens

At Meme Insider, we focus on the wild world of meme coins, but remember: Bitcoin is the tide that lifts (or sinks) all boats. When BTC experiences volatility from whale trades, meme tokens often amplify those moves. For instance, if this OG's short pays off and BTC dips, expect meme coins like DOGE or newer pumps to feel the heat, as traders rotate out of riskier assets. On the flip side, if the short gets squeezed (price rises, forcing closures), it could spark a rally that boosts meme sentiment.

Recent similar activities, as reported in various sources, show this whale has been adjusting positions frequently—fully closing a massive short for $92 million earlier in October, only to reopen and expand others. This pattern underscores the high-stakes trading environment, where leveraged bets can yield huge rewards.

One reply to the thread noted another "bigger whale" opening and increasing a BTC short around the same time, with 18x leverage on a $71 million position. Such concurrent bearish bets from big players could hint at coordinated sentiment or just independent reads on overbought conditions.

Wrapping Up: Lessons for Blockchain Practitioners

Moves like these remind us why on-chain analysis is crucial for understanding market dynamics. Tools like Hyperbot and Arkham make it easier to track whales without needing a crystal ball. For meme token traders, staying attuned to BTC's big players can help navigate pumps and dumps.

If you're diving into meme coins or leveraged trading, always remember: DYOR (do your own research) and never risk more than you can afford to lose. What's your take on this whale's strategy? Drop a comment below or check out our knowledge base for more insights on crypto trends.