In the fast-paced world of crypto, companies are always looking for ways to stack their holdings and ride the next big wave. BitMine Immersion Technologies, trading under BMNR on NYSE American, just dropped some major news that's got everyone talking. They've scooped up another 179,251 ETH last week, pushing their total to a whopping 2,830,151 ETH—valued at around $12.97 billion at current prices. That's not just pocket change; it's positioning them as the top dog in Ethereum treasuries worldwide.

Breaking Down BitMine's Latest Moves

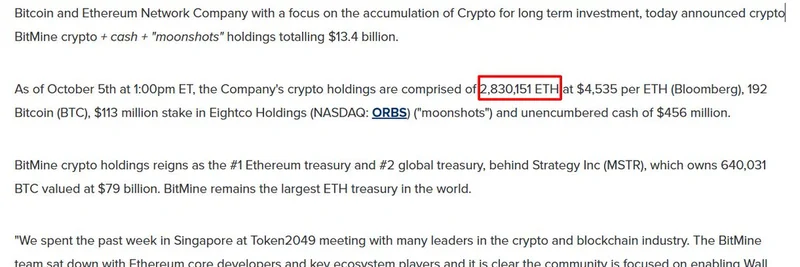

According to their recent press release, BitMine's overall crypto and cash holdings now sit at $13.4 billion. This includes their massive ETH stash, a smaller 192 BTC (worth about $79 billion? Wait, no—that's a reference to MicroStrategy's holdings for comparison), a $113 million stake in Eightco Holdings (NASDAQ: ORBS), which they're calling their "moonshots," and $456 million in straight cash. For context, ETH is the native token of the Ethereum blockchain, powering everything from smart contracts to decentralized apps—and yes, a ton of those viral meme tokens we love.

This isn't a one-off buy. Just a week earlier, they announced adding 234,846 ETH, bringing them to 2,650,900 tokens. They're on a buying spree, and it's clear they're not slowing down. As of October 5, 2025, they're holding over 2% of ETH's total supply, with eyes set on hitting 5%—what their chairman calls the "alchemy of 5% of ETH."

Who’s Backing This ETH Powerhouse?

BitMine isn't going it alone. They've got a star-studded lineup of investors cheering them on, including ARK Invest's Cathie Wood, MOZAYYX, Founders Fund (that's Peter Thiel's crew), Bill Miller III, Pantera Capital, Kraken, DCG (Digital Currency Group), Galaxy Digital, and personal investor Thomas "Tom" Lee from Fundstrat. Tom Lee, who's also BitMine's chairman, shared some insights after attending Token2049 in Singapore. He emphasized how Ethereum's community is laser-focused on integrating Wall Street and AI, making it the go-to platform for the next supercycle in tech and finance.

"Ethereum remains the premier choice given its high reliability and 100% uptime," Lee said. "These two powerful macro cycles [AI and crypto] will play out over decades." It's this kind of backing that gives BitMine the firepower to keep accumulating.

How Does This Tie into Meme Tokens?

At Meme Insider, we're all about those wild, community-driven meme tokens that often launch on Ethereum. So, why does BitMine's ETH hoarding matter here? Well, Ethereum is the backbone for most meme coins—from Dogecoin-inspired pups to quirky frogs and everything in between. A company like BitMine building such a huge treasury could stabilize ETH's price over the long term, potentially leading to lower gas fees (those pesky transaction costs) during bull runs. That means easier launches and trading for new meme projects.

Plus, their "moonshots" investments—like the stake in ORBS—hint at a appetite for high-risk, high-reward plays. Moonshots are basically crypto slang for bets that could skyrocket, much like hitting it big on a viral meme token. If BitMine starts dipping into meme-related ventures, it could bring more institutional money into the space, boosting liquidity and hype for everyone.

Market Implications and What's Next

BitMine's strategy puts them right behind MicroStrategy (MSTR) as the second-largest crypto treasury globally, but they're the undisputed champ for ETH. With ETH trading around $4,535 per token (per Bloomberg data), their holdings are a bet on Ethereum's future growth, especially as AI integrations and layer-2 solutions make the network faster and cheaper.

For blockchain practitioners and meme enthusiasts, this is a reminder that big players are betting heavy on ETH. It could signal a maturing market where institutions cozy up to the tech powering your favorite memes. Keep an eye on BitMine's stock (BMNR), which has been surging on these announcements—up 6% recently, according to Yahoo Finance.

If you're diving into meme tokens, understanding moves like this helps you navigate the bigger picture. Ethereum's ecosystem is evolving, and with supporters like BitMine, it's geared up for some exciting times ahead. What do you think—will they hit that 5% goal? Drop your thoughts in the comments!