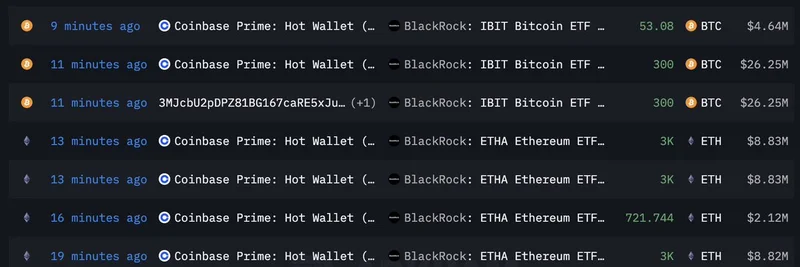

If you're tuned into the crypto scene, you've probably caught wind of the latest move by BlackRock, the world's largest asset manager. In a flurry of transactions over just 20 minutes, BlackRock's spot Bitcoin and Ethereum ETFs received a hefty influx of assets from Coinbase Prime. We're talking 953 BTC worth about $83.43 million and 15,722 ETH valued at around $46.24 million. This kind of activity isn't just routine—it's a strong signal of growing institutional interest in crypto's top assets.

The data comes straight from on-chain tracker Lookonchain, who spotted these transfers in real time. For those new to this, ETFs (Exchange-Traded Funds) like BlackRock's IBIT for Bitcoin and ETHA for Ethereum allow traditional investors to gain exposure to crypto without directly holding the coins. When funds flow in like this, it often means big players are betting on price appreciation.

Breaking Down the Transactions

Let's unpack what happened. The transfers originated from Coinbase Prime's hot wallet, a secure storage used for active trading and custody services. Here's a quick rundown of the key moves:

- Bitcoin Inflows: Multiple batches including 300 BTC (twice), another 300 BTC from a separate address, and a smaller 53 BTC chunk. Total: 953 BTC at current prices around $87,500 per coin.

- Ethereum Inflows: Several 3,000 ETH transfers, plus a 722 ETH addition. Total: Over 15,700 ETH, with ETH trading near $2,940.

These aren't isolated events. BlackRock has been aggressively accumulating since launching their spot ETFs earlier this year, pushing their assets under management into the billions. Check out the full entity explorer on Arkham Intelligence for more granular details.

Why This Matters for the Broader Crypto Market

Institutional buying like this is a classic bull market indicator. When giants like BlackRock load up, it boosts liquidity and confidence across the board. Bitcoin and Ethereum often act as the "blue chips" of crypto—stable, established, and gateways for new capital. As their prices stabilize or climb, that money tends to rotate into higher-risk, higher-reward assets.

Think about it: With BTC holding above $90K support levels and ETH eyeing $3,500, the market sentiment is shifting from fear to greed. We've seen this pattern before—ETFs inflows in 2024 led to all-time highs, and now in late 2025, it could be setting the stage for another leg up.

The Meme Coin Connection: Opportunity Knocks

Now, here's where it gets exciting for meme token enthusiasts. Meme coins thrive on hype, community, and market momentum. When institutional money pours into BTC and ETH, it creates a ripple effect:

- Increased Liquidity: More capital in the ecosystem means easier pumps for volatile assets like memes.

- Risk-On Environment: Investors feeling bullish on majors often chase altcoins and memes for quick gains.

- Narrative Boost: Stories of "BlackRock buying the dip" fuel social media buzz, drawing retail traders back in.

Take recent examples—during past ETF hype cycles, memes like Dogecoin, Shiba Inu, and newer ones on Solana exploded. If this inflow trend continues, watch for rotations into trending memes. Communities on platforms like X are already buzzing, with traders calling it a "stealth accumulation" phase.

Of course, meme coins are speculative, so always DYOR (Do Your Own Research) and manage risk. But moves like BlackRock's remind us that crypto is maturing, and memes are part of that evolution.

Stay ahead of the curve with Meme Insider for more updates on how traditional finance is intersecting with the wild world of meme tokens. What's your take—bullish on memes? Drop your thoughts below!