DeFAI: Is AI the Next Big Thing in Crypto After Meme Coins?

Remember the DeFi craze? It took the crypto world by storm back in 2020. Decentralized Finance promised a new way to manage your money, cutting out the traditional banks and putting you in control. But let's be honest, it got complicated fast. So many different blockchains, tokens, and platforms popped up that even crypto veterans started scratching their heads.

Now, enter Artificial Intelligence (AI). You've probably heard the buzz – from chatbots to self-driving cars, AI is changing everything. And guess what? It's also making waves in the crypto space, giving rise to something called DeFi AI, or DeFAI for short.

Think of DeFAI as the smart evolution of DeFi. It's where AI steps in to make DeFi easier to use, safer, and potentially more profitable. How? By automating tasks, managing risks, and optimizing how your crypto is used.

How Does DeFAI Actually Work? Breaking it Down

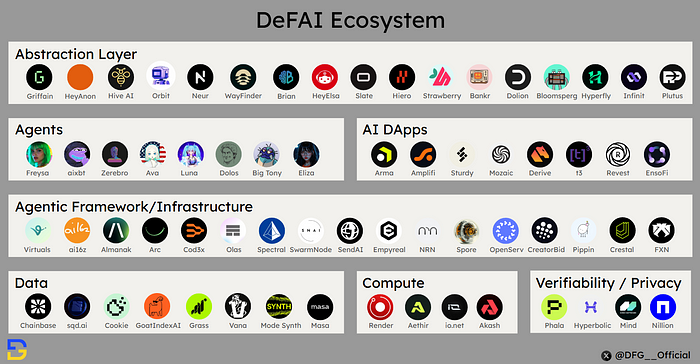

DeFAI isn't some magic black box. It's built on layers, kind of like a meme coin skyscraper, but with more brains.

First, you've got the blockchain layer. This is the foundation – the actual cryptocurrency network, like Ethereum or Solana, where everything happens. AI agents need to interact with these blockchains to make trades and manage your assets using smart contracts (those self-executing agreements on the blockchain).

Then comes the data and compute layer. AI learns from data, lots of it. This layer provides the information AI needs – things like past crypto prices, market trends, and on-chain activity. Think of it as the AI's crypto knowledge base. Powerful computers are also needed to crunch all this data and train the AI models.

Next up is privacy and verifiability. In crypto, trust is key. These layers ensure your financial data stays secure and that everything the AI does is transparent and can be verified. No shady business here!

Finally, we have agentic frameworks. This is where the AI magic happens. These are tools that allow developers to build specific AI applications for DeFi, like trading bots that can automatically buy and sell crypto, systems that assess the risk of lending out your crypto, or even tools to help make better decisions in decentralized governance.

DeFAI: Not Without its Hurdles

Building DeFAI isn't a walk in the park. There are some real challenges to overcome.

One big one is data. AI needs good data to make smart decisions. In the fast-paced crypto market, things change in seconds. DeFAI systems need real-time data feeds to execute trades effectively. If the data is bad, the AI can make mistakes, leading to losses.

Another challenge is crypto volatility. Meme coin traders know all about volatility! Crypto markets are wild, and AI models need to be trained on a lot of different kinds of data to handle these swings and remain effective. Predicting the next Doge or Shiba Inu pump? That's AI level hard mode.

Finally, getting a complete picture of the market is crucial. AI needs to understand how different assets are connected, where the money is flowing, and what the overall market sentiment is. It's like trying to read the mind of the crypto market, but for AI.

Protocols tackling these challenges are gaining attention. But to really take DeFAI to the next level, they need to use a variety of high-quality data sources to make their products even better and smarter.

Data is King: Fueling DeFAI's Intelligence

Think of AI like a super-smart meme coin trader – but even the best trader is only as good as their information. For AI agents in DeFAI to really shine, they need data that's real-time, organized, and trustworthy.

Let’s look at some examples of how data is crucial:

- Making DeFi Easier: Some tools try to simplify DeFi by converting your instructions into actions, but they often can't predict market moves.

- Smart Trading: AI can analyze data to find good trades, but often can't execute those trades on its own.

- Automated DeFi Apps: AI-powered apps can manage crypto vaults or make trades, but they are often reacting to market changes rather than proactively anticipating them.

Key Players in DeFAI Data

Companies like Chainbase are stepping up to provide this essential data layer. They offer structured, on-chain data that's verifiable and ready for AI to use. This helps developers build custom data workflows to suit their specific DeFAI needs.

By standardizing and cleaning up raw blockchain data, these providers ensure that AI systems get the high-quality information they need. This reduces the time spent preparing data and improves the accuracy of AI models, leading to more reliable AI agents.

Chainbase, for instance, has developed an AI model called Theia. Theia is designed to translate complex on-chain data into easy-to-understand analysis, even if you don't know how to code.

The usefulness of Chainbase's data is clear in their partnerships with various AI projects, including:

- ElizaOS: Using Chainbase data for on-chain decision-making in their AI agent plugins.

- Vana AI: Building AI assistants powered by Chainbase data.

- Flock.io: Leveraging Chainbase for social network intelligence to understand user behavior in crypto.

- Theoriq: Utilizing Chainbase for DeFi data analysis and predictions.

- Partnerships with Blockchains: Collaborating with 0G, Aethir, and io.net.

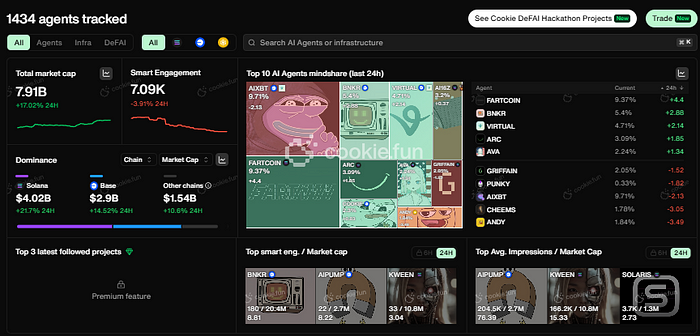

Where are DeFAI Agents Being Built?

Solana and Base have emerged as popular blockchains for building and launching AI agent frameworks and tokens. Solana's speed and low costs, combined with open-source tools like ElizaOS, have made it attractive for deploying AI agents. Base, with platforms like Virtuals, has also become a launchpad for DeFAI.

While Solana and Base offer hackathons and funding, Mode is making a strong push in AI initiatives within its blockchain ecosystem.

NEAR Protocol has also positioned itself as an AI-focused blockchain, offering features like an AI task marketplace, an open-source AI agentic framework, and a NEAR AI Assistant. They've recently announced a $20 million AI agent fund to further develop autonomous and verifiable AI agents on their platform.

Chainbase: Powering the Future of DeFAI

Chainbase stands out by providing verifiable, structured on-chain datasets across multiple blockchains. This data is designed to enhance AI agents for various purposes, including trading, gaining insights, making predictions, and finding new crypto opportunities.

They've introduced Manuscripts, a blockchain data streaming framework that integrates both on-chain and off-chain data. This allows for flexible querying and analysis, giving developers more control and power.

This customizable approach to data processing allows developers to tailor workflows to their specific needs. By standardizing and cleaning raw data, Chainbase ensures that datasets meet the demanding requirements of AI systems. This leads to faster data preparation and more accurate AI models, ultimately helping to create more reliable and effective AI agents.

Chainbase's commitment to data quality is evident in their development of Theia, which simplifies on-chain data analysis, and their growing list of partnerships with leading AI protocols.

Chainbase vs. Traditional Data Providers

Traditional data providers like The Graph, Chainlink, and Alchemy offer valuable services, but they aren't specifically focused on AI.

- The Graph: Provides a platform for querying and indexing blockchain data, offering raw data access, but it's not structured for AI-driven trading or strategy execution.

- Chainlink: Offers oracle data feeds, but lacks AI-optimized datasets for predictive analysis.

- Alchemy: Primarily focuses on providing RPC (Remote Procedure Call) services, which are essential for blockchain interaction, but not AI-specific data solutions.

In contrast, Chainbase is laser-focused on preparing datasets specifically for blockchain-related AI applications. Their focus on event logs and transaction details makes their data particularly valuable for AI agents operating across multiple blockchains.

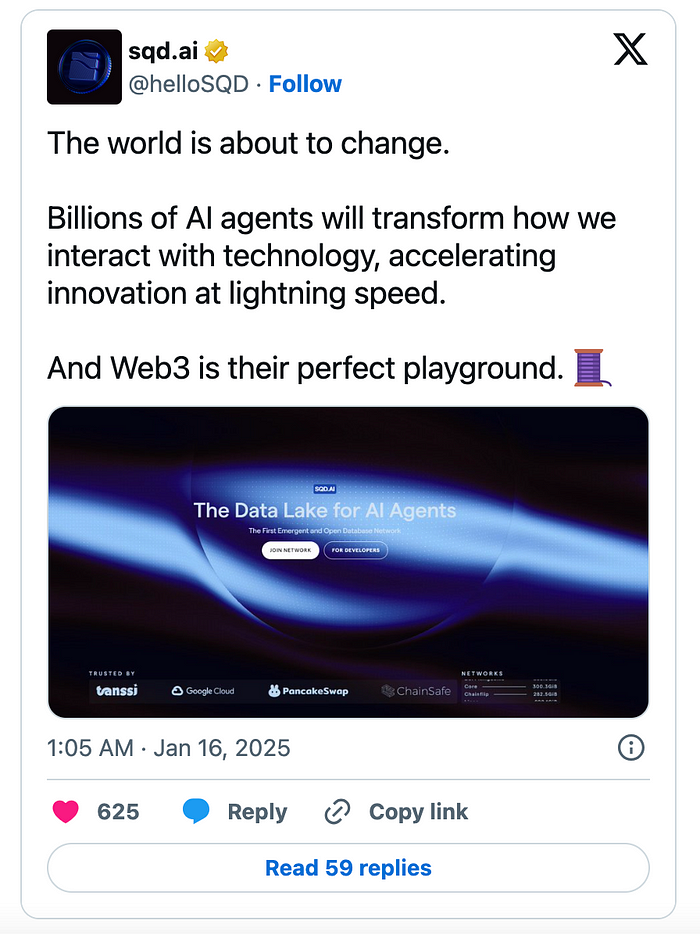

Square Root DAO (SQD), previously known as Subsquid, is another interesting player. They offer a modular database network designed for AI agents and Web3 services. SQD features an agent dashboard to track top AI agent trends on-chain and on social media. They've also launched a database swarm API, providing AI agents with real-time on-chain social data feeds to detect trending narratives and market sentiment shifts.

SQD’s database swarm covers over 7TB of real-time on-chain social data, offering insights into market sentiment and crypto Twitter trends. Their AI agent @agentcookiefun utilizes this data to provide market predictions and identify emerging opportunities.

The Future of DeFAI: Towards Full Autonomy

Currently, most AI agents in DeFi face limitations in achieving full autonomy. Many rely on abstract layers to translate user intentions into actions, but these layers often lack predictive capabilities.

Example Scenario: Imagine you want to swap ETH from Aave to Solana using an AI agent. The abstract layer can convert your intention into a transaction, but it might fail if it chooses an inefficient route or misses crucial market information.

Solution: The key to unlocking full autonomy in DeFAI lies in verifiable agentic decision-making systems. These systems ensure transparency, security, and accountability in AI-driven processes. Users need to be confident that their funds are safe and that AI agents are acting in their best interest, without manipulation or corruption.

Conclusion: High-quality, real-time data is essential to improve the predictive capabilities and execution efficiency of AI agents in DeFi.

Proof of Concept: Verifiable agentic decision-making systems can provide the necessary security and accountability for users to trust AI agents with their assets. This approach empowers users to manage their crypto through interactions with their own AI agents, reducing reliance on third-party services and mitigating risks.

Learn More: Fraud-Proof Token-Based Verifiable Agentic Decision-Making System

Final Thoughts: DeFAI - Trend or Revolution?

While some might see DeFAI as just another fleeting crypto trend, especially given recent drawdowns in AI agent tokens and frameworks, it's crucial to remember that this space is still in its early stages.

The potential for AI to revolutionize DeFi is undeniable. The key to unlocking this potential lies in building robust data layers that provide AI agents with the high-quality, real-time information they need to make intelligent decisions. This includes gaining deeper insights into market sentiment, analyzing on-chain activity like liquidity shifts and trading strategies, and implementing verifiable decision-making systems.

As DeFAI continues to evolve, it could fundamentally change how we interact with DeFi, making it more accessible, efficient, and ultimately, more profitable for everyone, including meme coin enthusiasts looking for the next edge in the crypto market.