If you're keeping tabs on the fast-paced crypto scene, especially where meme tokens and innovative protocols intersect, Dune's latest Digest is a goldmine. This edition spotlights some standout projects shaking things up. From Solana's buzzing launchpads to novel voting mechanisms that could influence meme communities, here's a conversational rundown of the key highlights. For the full thread, check it out here.

HeavenDex Explodes as Solana's Go-To AMM and Launchpad

HeavenDex has taken off on Solana, blending automated market maker (AMM) features with a launchpad for new tokens—think easy meme token launches without the usual pitfalls. What sets it apart? No bonding curves (which can lead to volatile price swings), anti-scam fees to deter rugs, and a "god flywheel" where all fees go toward buying and burning $LIGHT, their native token. This creates a self-sustaining loop that rewards the community.

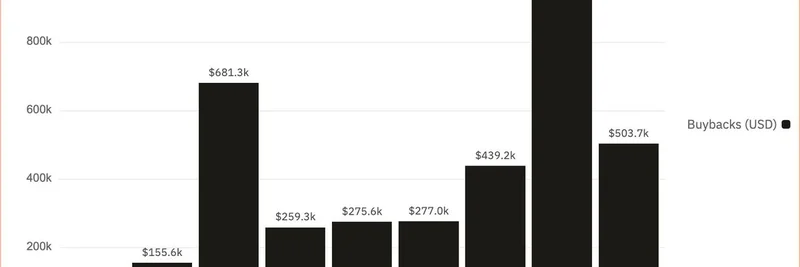

The numbers are impressive: $308 million in trading volume, 35,000 tokens launched (many likely memes given Solana's vibe), 108,000 wallets onboarded, and $3.6 million in buybacks leading to 3.5% of the supply burned. It's a prime example of how launchpads are evolving to support the meme token ecosystem safely and efficiently.

JokeRace Evolves from DAO Votes to Persuasion Markets

Starting as a fun way for DAOs to vote on jokes back in 2022, JokeRace has morphed into something bigger: tokenized contests and now "persuasion markets." These are like prediction markets but focused on convincing others through votes. Their Vote-to-Earn v2 incentivizes early believers with exponential price curves—vote early, pay less, and potentially earn more if your pick wins.

Stats show the traction: 46,000 voters, 12,000 entries, 55,000 paid votes totaling $1.86 million spent, and $165,000 in protocol revenue just in August. For meme token enthusiasts, this could be a game-changer for community governance or hype-building contests.

Football.Fun Reinvents Fantasy Sports on Base

Imagine Sorare but upgraded: Football.Fun on Base offers fractional ownership of player cards (no seasonal resets), liquid trading markets, pack openings, and skill-based leaderboards. It's rebooting fantasy football in crypto, making it more accessible and engaging.

Early metrics since the Pro launch: 1,985 unique depositors, $3.5 million deposited, and $5.9 million in trading volume. While not directly meme-related, the gamified elements could inspire similar mechanics in meme token projects.

BENJI RWA: Tokenized Treasuries Gaining Ground

BENJI, from Franklin Templeton, is a tokenized U.S. Treasury fund—an example of real-world assets (RWAs) bridging TradFi and crypto. It now boasts $686 million in assets under management (AUM) across 850 investors, over $50 million in dividends paid, and $87 million in peer-to-peer transfers.

Notably, 65% of the AUM is on Stellar, with strong presence on Arbitrum, Base, and others. This highlights how tokenized assets are becoming a staple, potentially influencing stablecoin-like mechanisms in meme ecosystems.

Kiln Finance's TVL Boom via Wallet Integrations

Kiln Finance has skyrocketed from under $1 million in TVL a year ago to $395 million in August, thanks to embedding yields directly into popular wallets. Key contributors: Ledger at 63% ($250M+), Trust Wallet at 26% ($100M+), Safe at 6%, and Bitpanda onboarding 7 million users to yields.

This shift shows DeFi adoption moving toward seamless, wallet-powered experiences—perfect for meme token holders looking to earn passive income without complex setups.

Wrapping up, Dune Digest 24 underscores how crypto is innovating at breakneck speed, from meme-friendly launchpads to integrated DeFi. If you're building or trading in the meme token space, these trends could shape your next moves. Stay tuned for more updates, and don't forget to subscribe to Dune's newsletter for data-driven insights straight to your inbox.