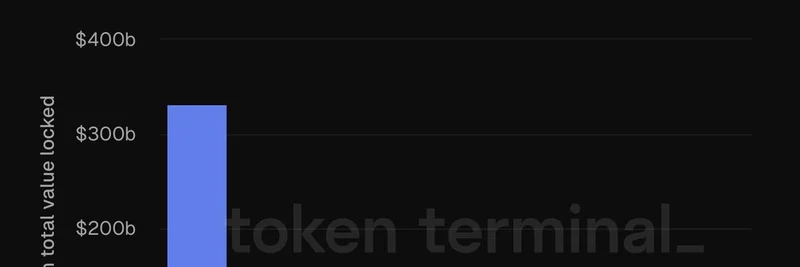

In the ever-evolving world of blockchain, Total Value Locked (TVL) is a key metric that shows how much user assets are deposited into applications on a particular chain. Think of it as a measure of trust and activity— the more money locked in, the more vibrant the ecosystem. Recently, a tweet from Token Terminal highlighted some eye-opening figures that put Ethereum way ahead of the pack.

According to the data shared on X (formerly Twitter), Ethereum hosts a staggering $

- Let's search for the tweet content to get the image URL and details.

330 billion in user assets. That's not just big; it's dominant. Trailing behind are Tron with about $82 billion and Solana with $34 billion. These are the only three chains boasting over $30 billion in TVL right now.

Why This Matters for Meme Tokens

At Meme Insider, we're all about meme tokens, those fun, community-driven cryptos that can skyrocket on hype alone. But where do they thrive? Solana has become a hotspot for meme tokens thanks to its speed and low fees—think Pump.fun and all those viral launches. With $34 billion in TVL, it's clear users are pouring money into Solana-based apps, which often include DEXs where memes trade wildly.

Ethereum, despite higher fees on its mainnet, benefits from its Layer 2 solutions like Base and Arbitrum. These L2s are included in the broader Ethereum ecosystem TVL, making it a powerhouse for more established meme projects or those integrated with DeFi protocols. Tron's TVL is boosted by stablecoins and DeFi, but it's also home to some meme activity, especially in emerging markets.

Breaking Down the Rest of the Pack

The chart doesn't stop at the top three. Other notable chains include:

- Arbitrum One: Around $15-20 billion (estimated from the visual), a popular Ethereum L2 for scaling DeFi and potentially memes.

- Base: Coinbase's L2 on Ethereum, gaining traction for user-friendly apps and meme communities.

- BNB Chain: Binance's ecosystem, known for PancakeSwap and various meme tokens.

- Avalanche: Focuses on subnets and has seen meme surges in the past.

- Polygon: Another Ethereum scaler with a strong DeFi presence.

These chains have TVL well under $30 billion, but they're crucial for diversification in the meme space. For blockchain practitioners, this data underscores Ethereum's security and maturity, while Solana offers agility for quick meme flips.

What’s Next for These Ecosystems?

As we head deeper into 2025, keep an eye on how TVL shifts with market trends. Meme tokens often ride waves of speculation, so chains with rising TVL could signal hot spots for new launches. If you're building or trading memes, platforms like Solana might offer the best bang for your buck in terms of speed, but Ethereum's vast liquidity ensures longevity.

For more insights on meme tokens and blockchain news, stick with Meme Insider. We've got the knowledge base to help you level up in this wild crypto world.