In the fast-paced world of crypto, where market sentiment can shift overnight, a recent update from Polymarket has caught everyone's attention. Just a week ago, the decentralized prediction market showed only a 35% chance of the Federal Reserve cutting interest rates by 25 basis points (that's 0.25% for the uninitiated) in December. Fast forward to now, and that probability has skyrocketed to 80%. This surge could be the catalyst Bitcoin needs to smash through the $100,000 barrier.

Why This Matters for Crypto Enthusiasts

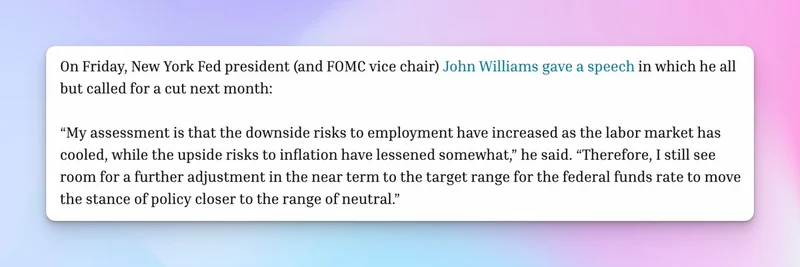

Polymarket, a platform built on blockchain where users bet on real-world events using crypto, often serves as a crystal ball for market trends. It's like a decentralized version of traditional betting sites but powered by smart contracts on networks like Polygon. When odds shift this dramatically, it reflects growing consensus among traders that the Fed might ease monetary policy sooner than expected. Lower interest rates typically mean cheaper borrowing, which can fuel investment in riskier assets like cryptocurrencies.

For Bitcoin specifically, breaking $100K has been a psychological milestone that's eluded it despite recent rallies. With BTC hovering around all-time highs, this added optimism from rate cut expectations could provide the push needed. As Edgy from The DeFi Edge pointed out in his tweet, this development "could be what we need to break past 100k BTC." And he's not alone—replies from the community echo the excitement, with users like @goon_crypto joking about how their altcoin bags need this boost.

Implications for Meme Tokens and the Broader Market

While Bitcoin often leads the charge, meme tokens aren't far behind in reacting to macro events. These fun, community-driven coins—like Dogecoin or newer entrants—thrive on hype and liquidity. A Fed rate cut could inject more capital into the crypto ecosystem, potentially sparking a meme coin frenzy. We've seen it before: when traditional markets loosen up, speculative assets in DeFi and memes get a disproportionate lift.

Think about it—lower rates might encourage more retail investors to dip into high-risk, high-reward plays. Platforms like Polymarket not only predict these events but also allow users to hedge or profit from them directly. If you're into meme tokens, keeping an eye on such predictions can help you time entries or exits better.

Staying Ahead in the DeFi Game

As we at Meme Insider always emphasize, understanding these intersections between traditional finance and crypto is key to leveling up your strategy. Whether you're a seasoned trader or just starting, tools like Polymarket offer valuable insights without the need for centralized intermediaries.

If this rate cut materializes, expect volatility—but also opportunity. Follow updates on The DeFi Edge's Twitter for more real-time analysis, and dive into our knowledge base for guides on navigating prediction markets and meme token trends. What's your take—will BTC hit $100K by year-end?