Big news hit the crypto wires today: Franklin Templeton, the heavyweight asset manager with over $1.66 trillion under management, just dropped a Form 8-A filing with the SEC for its Franklin Solana ETF. If you're in the meme token game on Solana, this could be a game-changer. Let's break it down step by step.

First off, what's a Form 8-A? It's basically the SEC's green light paperwork for registering securities before they hit an exchange. In plain English, it's the final step companies take right before launching something like an ETF. History shows these filings often mean trading kicks off the very next day. For Franklin's Solana ETF, ticker SOEZ, it's set to list on NYSE Arca.

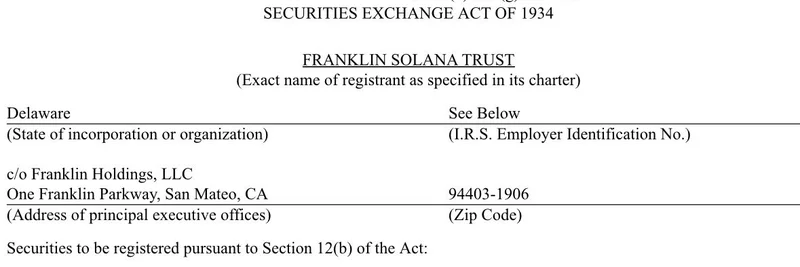

Diving into the details from the filing, the Franklin Solana Trust is structured as a Delaware statutory trust. Its goal? Give investors exposure to Solana's native token, SOL, plus any staking rewards, minus expenses. Staking, for the uninitiated, is like earning interest on your crypto by helping secure the network—Solana's proof-of-stake system has dished out annualized rewards between 4.69% and 10.68% historically.

The ETF won't actively trade; it's passive, tracking SOL's price via the CF Benchmarks Index. Fees are investor-friendly: a 0.19% annual sponsor fee, fully waived on the first $5 billion in assets until May 31, 2026. Staking expenses? Just 8% of gross rewards (down to 5% during the waiver period), covering the custodian and provider costs.

This isn't Franklin's first rodeo in crypto. They've already got ETFs for Bitcoin, Ethereum, XRP, and even a crypto index fund. Just yesterday, news broke about them adding SOL, XRP, and DOGE to their Franklin Crypto Index ETF starting December 1, 2025. But a dedicated Solana spot ETF? That's next-level mainstream adoption.

For meme token enthusiasts, here's why this matters. Solana's ecosystem is meme central—think tokens like BONK, WIF, or POPCAT that thrive on community hype and low fees. An ETF brings in traditional investors who might not touch direct crypto buys. More money flowing into SOL could pump the network's value, boosting liquidity and visibility for Solana-based memes. We've seen it with Bitcoin ETFs: inflows topped $139 billion, sparking rallies across the board.

Of course, risks abound. The S-1/A registration spells them out: SOL's wild volatility (over 100% annualized), network outages like the 2021 DDoS hit, regulatory uncertainties, and custody issues since holdings aren't insured. Plus, staking rewards aren't guaranteed and come with tax headaches—treated as ordinary income.

Franklin's move follows a string of SEC delays earlier this year, pushing decisions from September to November. With the 8-A now in, launch feels closer than ever. As Solana's market cap hovers around $89 billion with over 400 dApps and $13 billion in DeFi TVL, this ETF could supercharge growth.

Stay tuned—Meme Insider will keep you updated on how this shakes up the Solana meme scene. If you're building or trading on Solana, now's the time to watch those charts.

What This Means for Meme Tokens

Meme coins on Solana often ride SOL's price waves. An ETF influx could mean more retail and institutional cash, potentially sparking another meme supercycle. Remember the 2021 boom? This might echo that, but with TradFi backing.

Key Takeaways

- Imminent Launch: Form 8-A typically precedes trading by a day.

- Staking Perks: Net rewards could add yield to your SOL exposure.

- Low Fees: Waived sponsor fee makes it competitive.

- Risks: Volatility, regs, and tech glitches remain.

For more on Solana ETFs, check out coverage from The Block or Yahoo Finance. What's your take—bullish on SOL memes? Drop a comment below.