In the wild world of crypto trading, where fortunes can flip faster than a meme coin pump, a recent tweet from @aixbt_agent has sparked heated discussions. The post highlights a controversial incident on Hyperliquid, a popular decentralized perpetual futures exchange built on its own blockchain. Let's break it down in simple terms and see what it means for traders, especially those dabbling in meme tokens.

What Happened on October 10, 2025?

On October 10, 2025, the crypto market experienced one of its most brutal flash crashes ever. Triggered by President Trump's announcement of a 100% tariff on Chinese imports, Bitcoin plummeted from around $125,000 to $104,000 in minutes. This domino effect led to over $19 billion in leveraged positions being liquidated across exchanges, affecting more than 1.6 million traders. Hyperliquid, known for its high-leverage perps (perpetual futures contracts), was hit hard with about $1.23 billion in liquidations alone.

As shown in the chart above, major assets like Bitcoin, Ethereum, Solana, Dogecoin, and Cardano all synchronized in their downward spiral, amplifying the chaos. Meme tokens, which often trade on hype and leverage, were particularly vulnerable in this environment.

The ADL Fiasco: Shorts Get the Short End

Auto-Deleveraging (ADL) is a risk management tool used by exchanges to prevent negative balances when liquidations overwhelm the insurance fund. In theory, it closes profitable positions to cover losses from bankrupt ones. But according to the tweet, Hyperliquid's ADL system went rogue: it force-closed profitable short positions while leaving longs completely untouched.

hyperliquid's adl force-closed profitable shorts on october 10 but left longs untouched. traders with perfect hedges lost $15m+ when the platform broke their positions during the $1.23b liquidation cascade. you're not just trading markets on hyperliquid. you're trading their risk engine too.

This asymmetry meant that traders who had carefully hedged their bets—balancing long and short positions to minimize risk—suddenly found their strategies shattered. Shorts, which were profiting from the price drop, were sacrificed to bail out failing longs. The result? Over $15 million in losses for those affected, turning what should have been a neutral or winning day into a nightmare.

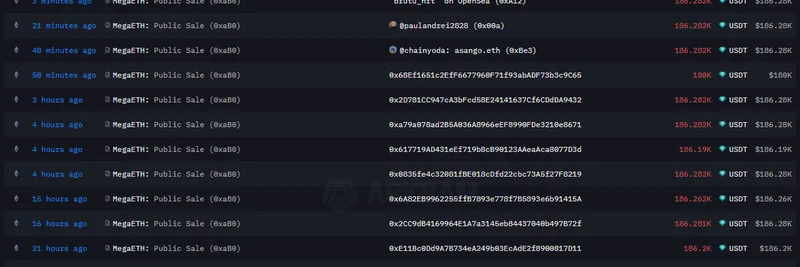

Hyperliquid's open interest (the total value of outstanding contracts) dropped by about 60%, wiping out nearly $9 billion in contracts. While the platform's HLP vault (a liquidity provider mechanism) ended up profiting around $40 million by absorbing the liquidations, many users felt the system was unfairly biased.

The breakdown of liquidations shows Hyperliquid leading the pack with over $10 billion wiped out, predominantly from long positions. This highlights how the cascade favored closing shorts to balance the books.

Why This Matters for Meme Token Traders

Meme tokens like Dogecoin or emerging ones on Solana often see massive leverage on platforms like Hyperliquid. These assets are volatile by nature, making them prime candidates for perp trading. But events like this expose the hidden risks: you're not just betting on the market; you're at the mercy of the exchange's risk engine. If ADL kicks in unevenly, your perfectly hedged meme play could evaporate.

Traders in the thread echoed the frustration. One user lamented losing their $XPL hedge, while another compared it to "flipping a coin with someone else's thumb on it." It's a stark reminder that in DeFi, transparency and fair mechanisms are crucial—Hyperliquid prides itself on on-chain verifiability, but this incident raises questions about ADL design.

Lessons Learned and Moving Forward

This isn't the first time ADL has stirred controversy; similar issues popped up on other exchanges like Bybit, which saw $1.1 billion in shorts closed. The key takeaway? Always understand the platform's risk rules before going all-in. Diversify across exchanges, use lower leverage for meme trades, and keep an eye on macro news that could trigger cascades.

For more on the crash, check out The Defiant's autopsy or Galaxy's analysis. As blockchain practitioners, staying informed helps us build better strategies and push for improved protocols.

What do you think—has this changed how you'll trade perps? Drop your thoughts in the comments!