Diving into HyperSwap’s Points Program: A Goldmine for DeFi Farmers

If you’re into decentralized finance (DeFi) and looking for the next big opportunity, HyperSwap on HyperEVM might just be your ticket. A recent post by Prince (@PetitPrinceETH) on April 10, 2025, breaks down the most profitable liquidity pools (LPs) to farm points in HyperSwap’s ecosystem. With an upcoming SWAP token airdrop on the horizon, these points could translate into serious rewards. Let’s unpack the details, explore the best strategies, and see what this means for you.

What Is HyperSwap and Its Points Program?

HyperSwap is the first native decentralized exchange (DEX) built for the HyperEVM ecosystem, a platform designed for Hyperliquid users. It allows you to trade tokens, provide liquidity, and even launch your own tokens in a permissionless environment. On April 3, 2025, HyperSwap launched its Ecosystem Points Program, a 5-week campaign to reward community engagement. Here’s the breakdown:

- Total Points: 2,500,000

- Weekly Emissions: 500,000 points

- Duration: 5 weeks, with distributions every Sunday at 10 PM PST (starting April 13, 2025)

- Partners: 21 protocols, including HypurrFi, Felix Protocol, and HyperLend

You earn points by interacting with HyperSwap and its partner protocols—think providing liquidity, staking, borrowing, or holding specific tokens. These points are tied to an upcoming SWAP token airdrop, making them a hot commodity for DeFi farmers.

Prince’s Analysis: Crunching the Numbers

Prince created an Excel sheet to analyze HyperSwap’s LPs, focusing on points earned per $1,000 of Total Value Locked (TVL). His method splits the calculation 50/50 between TVL and weekly fees, giving a balanced view of profitability. He categorizes the LPs into three groups: Stablecoin (low risk), Majors (medium risk), and Degen (high risk). Let’s look at the highlights.

Stablecoin LPs: Low Risk, Steady Gains

Stablecoin pools are the safest bet since they involve assets like USDXL and feUSD, which are pegged to stable values. Here’s the data Prince shared:

- Top Performer: KEI/USDXL #3

- TVL: $519.26

- Weekly Fees: $23.33

- Points/Week per $1,000: 54.73

- Estimated APY: 338% (based on points value)

With $1,000 in this pool, you’d earn about 54.73 points per week, which Prince estimates at $30/week in value. That’s a solid 338% annual percentage yield (APY) for a low-risk pool—pretty impressive for stablecoins!

Majors LPs: Medium Risk, High Rewards

Majors involve more volatile assets like HYPE, uETH, and uBTC, so there’s a bit more risk but also higher rewards. Here’s the table:

- Top Performer: HYPE/uETH

- TVL: $3548.58

- Weekly Fees: $7391.19

- Points/Week per $1,000: 109

- Estimated APY: 2018%

For $1,000 in the HYPE/uETH pool, you’re looking at 109 points per week, or about $65/week in value. That translates to a jaw-dropping 2018% APY. But keep in mind, the volatility of HYPE and uETH means your capital could fluctuate significantly.

Degen LPs: High Risk, Insane Returns

Degen pools are for the risk-takers, featuring tokens like HYPE/GENESY and FLY/HYPE. The rewards are massive, but so is the volatility. Here’s the data:

- Top Performer: HYPE/GENESY

- TVL: $6290.33

- Weekly Fees: $83.34

- Points/Week per $1,000: 200.69

- Estimated APY: 12,136%

With $1,000 in HYPE/GENESY, you’d earn 200.69 points per week, or $120/week in value. That’s an insane 12,136% APY! But these tokens can be highly volatile, so you’re taking on significant risk of impermanent loss or price swings.

How Much Are HyperSwap Points Worth?

Prince estimates the value of 1 point based on HyperSwap’s potential fully diluted valuation (FDV) and airdrop allocation:

- FDV Range: $30M to $70M

- Airdrop Allocation: 20% of the supply

- Point Value: $0.60 to $1.40

This estimation aligns with HyperSwap’s confirmed SWAP token airdrop, which will reward users based on their points. So, those 200.69 points from the HYPE/GENESY pool could be worth $120 to $280 per week at these valuations.

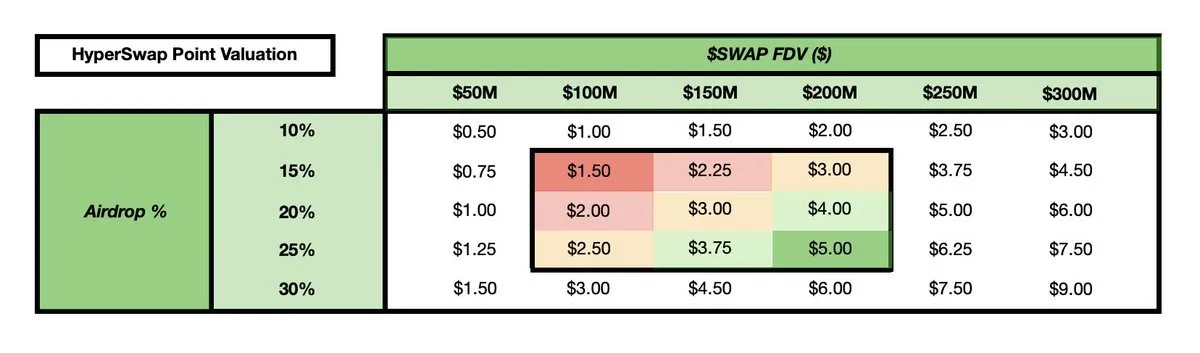

Prince also shared a valuation table to show how point values change with different FDVs and airdrop percentages:

For example, at a $50M FDV with a 20% airdrop, 1 point is worth $1.00. This table helps you gauge potential returns based on your own assumptions.

The Catch: Uniswap v3-Style Concentrated Liquidity

HyperSwap uses a Uniswap v3-style mechanism called concentrated liquidity. Unlike traditional pools where liquidity is spread across all price ranges, you choose a specific price range for your liquidity. For example, in a stablecoin pair like USDXL/feUSD, you might set your range between 0.99 and 1.01.

- Pros: You earn more fees (and points) because your capital is concentrated where trading happens most.

- Cons: If the price moves out of your range, you earn almost nothing—no fees, no points.

Prince warns that setting a range “out of range” is useless, a point echoed in replies to his post. A user, METSO, asked if a wider range is better to avoid this risk. Prince clarified that a wider range earns fewer points because it generates less fees, but a tight range risks being out of range entirely. Another user, Najdorf250, noted that the tightness of your range matters, which Prince confirmed.

Is It Worth Farming HyperSwap Points?

Let’s weigh the pros and cons:

Pros

- High APYs: Even stablecoin pools offer 338% APY, while Degen pools reach 12,136%.

- Airdrop Potential: Points could be worth $0.60–$1.40 each, making this a lucrative opportunity.

- Community-Driven: HyperSwap’s program involves 21 partners, showing strong ecosystem support.

Cons

- Volatility Risk: Majors and Degen pools can lead to impermanent loss or price crashes.

- Range Management: You need to actively manage your liquidity range to maximize points.

- Uncertainty: The final FDV and airdrop allocation aren’t set, so point values are speculative.

How to Get Started

Ready to farm some points? Here’s a quick guide based on HyperSwap’s official instructions:

- Visit the HyperSwap testnet and connect your wallet.

- Claim testnet ETH from the ‘Faucet’ page.

- Generate a unique referral code on the ‘Dashboard’ page (required to earn points).

- Start earning points by:

- Trading on the ‘Swap’ page.

- Providing liquidity via the ‘Liquidity’ page.

- Launching a token on the ‘Launcher’ page.

Prince also shared his referral code in the post, which you can use to support him: HyperSwap Referral Link. Just connect your wallet and create a Username ID to activate it.

Final Thoughts

HyperSwap’s Points Program is a fantastic opportunity for DeFi enthusiasts, offering high APYs and a chance at a valuable SWAP token airdrop. Prince’s analysis highlights the best LPs to farm, with options for all risk levels—from stablecoin pools like KEI/USDXL to high-risk Degen pools like HYPE/GENESY. But success requires understanding concentrated liquidity and managing your risks, especially with volatile assets.

Whether you’re a cautious farmer or a Degen looking for 12,000%+ APYs, HyperSwap has something for you. Just make sure to set your liquidity ranges wisely and keep an eye on those price movements. Happy farming!