Hey there, crypto enthusiasts! If you’ve been keeping an eye on the wild world of Bitcoin trading, you’ve probably heard about the latest rollercoaster ride involving a mysterious whale known as Aguila Trades. On July 31, 2025, the crypto community was buzzing after Onchain Lens dropped a bombshell thread revealing Aguila’s staggering $38.7M loss due to multiple liquidations. Let’s dive into this dramatic story and unpack what it means for traders and the market.

The Liquidation Nightmare Begins

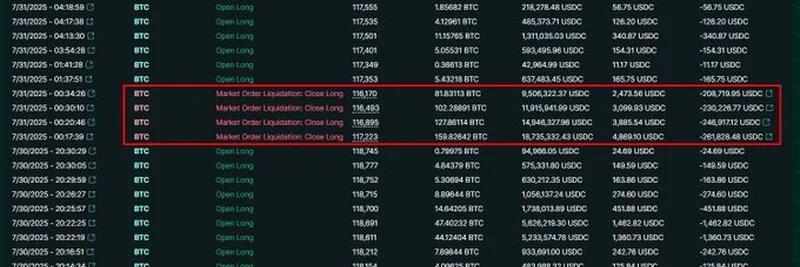

Picture this: a sudden drop in the Bitcoin market catches everyone off guard. For Aguila Trades, a well-known crypto whale (a term for someone holding a massive amount of cryptocurrency), this wasn’t just a minor hiccup—it turned into a full-blown disaster. The thread from Onchain Lens highlighted four consecutive liquidations, a rare and brutal event in trading. Liquidation happens when a trader’s position is automatically closed by an exchange because the market moves against them, wiping out their margin.

The first image in the thread (

A Glimmer of Hope—or Recklessness?

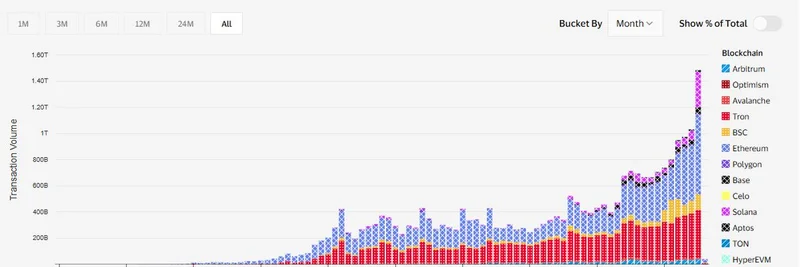

Despite the losses, Aguila didn’t throw in the towel. The whale doubled down, slightly increasing their Bitcoin position after the liquidations. This move is a classic case of trying to "average down"—buying more at a lower price to reduce the average cost. But with the market still shaky, as shown in the candlestick chart (

The chart reveals sharp price drops and volatility spikes, a clear sign of the market turmoil that triggered those liquidations. For those unfamiliar, candlestick charts track price movements over time, with red and green bars showing declines and gains. Aguila’s timing couldn’t have been worse, hitting a downtrend that wiped out their leverage.

The Bigger Picture: A $38.7M Hole

The third image (

Lessons for Crypto Traders

So, what can we learn from Aguila’s wild ride? First, risk management is king. The crypto market is notorious for its volatility, and even whales aren’t immune to sudden drops. Setting stop-loss orders (automatic sell triggers to limit losses) and avoiding over-leveraging could have softened the blow. Second, doubling down after a loss is a high-stakes move that requires perfect timing—something hard to nail in a chaotic market.

For those new to this space, a "whale" can sway prices with their massive trades, but they’re not invincible. Tools like CoinGlass can help track liquidations and market trends, while platforms like TradingView offer real-time charts to spot volatility. Aguila’s story is a stark reminder to stay cautious, even with deep pockets.

What’s Next for Aguila and the Market?

As of 08:24 AM +07 on July 31, 2025, the crypto world is watching Aguila closely. Will this whale bounce back with a savvy trade, or is this the beginning of a bigger unraveling? The community’s reactions on X range from sympathy to memes—like the gorilla image from SaraFisher—showing the mix of awe and amusement this drama has sparked.

At Meme Insider, we’re keeping our finger on the pulse of such events, especially how they tie into the meme token and broader blockchain world. Whether you’re a trader or just a curious observer, Aguila’s liquidation saga is a wild chapter in the ever-evolving crypto narrative. Stay tuned for more updates!