Hey folks, if you're knee-deep in the wild world of Solana DeFi, you've probably heard the buzz around yield-bearing tokens. They're like the gift that keeps on giving—earning you passive income while you hold, without the usual hassle of constant trading. But what if I told you there's one that's not just paying out, but actually showing an "up-only" price chart? Yeah, you read that right. Let's dive into ONyc, the star of a recent X post from DeFi analyst @jussy_world that's got the community chatting.

What Makes ONyc Tick?

At its core, ONyc is the yield-bearing token for OnRe, a reinsurance protocol built on Solana. Reinsurance? Don't worry if that sounds like insurance for insurance companies—it's basically a way to spread risk in the crypto world, and OnRe turns that into real yields for users. Think of it as putting your assets to work in a high-stakes game where the house (or in this case, the reinsurers) pays you to participate.

The magic here is the 13% APY baked right into ONyc. That's not some fleeting pump-and-dump promise; it's backed by actual reinsurance revenues flowing through the protocol. Holders get a steady drip of rewards just for sitting on their tokens, making it a no-brainer for anyone looking to stack sats without the volatility rollercoaster.

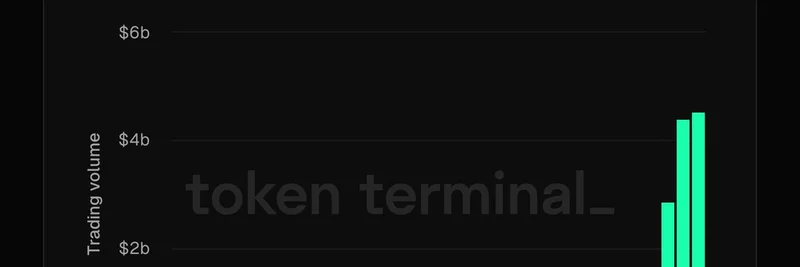

@jussy_world nailed it in their post: "this is what I call working yield-bearing token = ONyc of OnRe, backed by reinsurance yields generating 13% APY." And that chart? It's a beauty—pure upward trajectory, climbing from around $1.00 to $1.0524 with minimal dips. In meme token land, where "up-only" is more meme than reality, this one's living the dream.

Level Up Your Yields: Looping and Vault Strategies

But why stop at 13% when you can crank it to 25%? The Solana ecosystem shines with tools like Kamino Finance and LoopScale, where you can loop your ONyc collateral to amplify those gains. It's like leverage on easy mode: deposit, borrow against it, and redeposit to compound your yields. Risky? Sure, if you're overdoing it—but done right, it's a powerhouse for passive income.

Prefer hands-off? Just park your ONyc in OnRe's vaults for that reliable 13% APY. No looping required, minimal gas fees (thanks, Solana), and peace of mind knowing your funds are fueling real-world reinsurance plays.

Why ONyc Feels Like a Meme Token with Real Utility

Over at Meme Insider, we're all about those tokens that blend viral hype with actual tech. ONyc isn't your typical dog-themed moonshot—it's got reinsurance chops that could disrupt how DeFi handles risk. Imagine meme communities pooling into reinsurance pools for community-driven yields. That's the future we're eyeing.

Current stats from the chart? Market cap hovering at $1.05M, liquidity solid at $4M, and over 3K holders. Volume's picking up too, with 24-hour nets showing more buys than sells. If you're a blockchain practitioner hunting for the next edge, ONyc's worth a look—especially with Solana's meme token frenzy heating up.

Wrapping It Up: Is ONyc Your Next DeFi Play?

In a sea of rug pulls and fading pumps, ONyc stands out as a yield machine with an enviable chart. Whether you're looping for max gains or chilling in a vault, it's a smart add to any Solana wallet. Head over to OnRe's site to get started, and keep an eye on @jussy_world for more alpha drops.

What do you think—ready to reinsure your portfolio? Drop your thoughts in the comments. Stay memeing, stay yielding.

Disclaimer: This isn't financial advice—DYOR and trade at your own risk.