In the fast-paced world of decentralized finance (DeFi), hitting major milestones can make or break a project. Recently, a tweet from @BOBBYBIGYIELD highlighted an impressive feat: Project X reaching $10 million in Total Value Locked (TVL) in just three days. TVL, for those new to the space, refers to the total amount of assets deposited into a protocol, essentially measuring its popularity and trustworthiness among users.

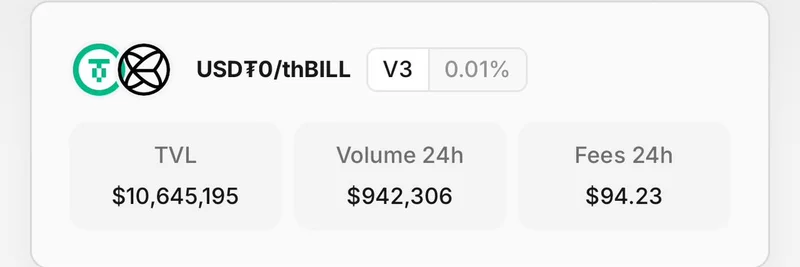

This screenshot shared in the tweet shows the USDT0/thBILL pool on Project X boasting a TVL of $10,645,195, with solid 24-hour volume and fees. It's a clear sign of rapid adoption.

Building on this, @munchPRMR pointed out something intriguing in their response: the TVL backing Project X (@prjx_hl) might actually be stronger than most decentralized exchanges (DEXs) due to its diversified liquidity sources. Unlike traditional Automated Market Maker (AMM) DEXs that are often confined to their own ecosystems, Project X pulls liquidity from multiple avenues:

- HyperEVM: The underlying layer providing efficient, high-speed transactions.

- Treasuries: Stable assets like treasury bills that add reliability and reduce volatility.

- Other EVM chains: Allowing cross-chain liquidity to flow in, expanding the pool beyond a single network.

This multi-source approach makes Project X particularly appealing, as @munchPRMR noted, compared to AMMs stuck in silos. It's like having a global network of resources versus a local pond—much deeper and more resilient.

The thread sparked engaging discussions. @BOBBYBIGYIELD agreed, emphasizing that this strength will grow as more spot assets get listed. Others like @Lamboland_ called it a "very good insight," while @Notnanoturner described it as an "aggregator" similar to Uniswap but with a broader, more even spread across niches.

For meme token enthusiasts and blockchain practitioners, this is exciting news. Project X, as a first-of-its-kind DEX on HyperEVM, could become a go-to platform for trading volatile assets like memes. Its diversified liquidity means better prices, lower slippage, and more stability—even during wild market swings that meme coins are known for.

@TheNestintern chimed in with "eating good on treasuries," highlighting the benefits of those stable backing assets. Meanwhile, @iwantlamboape praised the project's self-sufficiency, setting it apart from many others reliant on constant incentives.

Questions arose too, like from @Zola_web3: "Do you think that cross-chain liquidity depth could give them a real edge over traditional AMMs?" The consensus seems to lean yes, with @rodericuss calling multi-source TVL a "cheat code" against siloed AMMs.

Even concerns about user retention without incentives were raised by @PlutoOTF, but trust in the team's skills suggests long-term potential.

Overall, this thread underscores Project X's rapid rise and innovative model. If you're diving into DeFi or hunting for the next big meme trading hub, keep an eye on @prjx_hl. With TVL climbing and community buzz growing, it might just redefine how we think about liquidity in the blockchain space.