Raydium's Rollercoaster: How Much Does It Really Depend on Pump.fun Hype?

Solana's leading decentralized exchange (DEX), Raydium (RAY), took a nosedive today. The apparent trigger? Whispers that pump.fun, the meme coin launchpad sensation, might be rolling out its own Automated Market Maker (AMM) liquidity pools. The crypto-verse is buzzing with speculation that this could mean future pump.fun-born tokens, after their initial "internal" trading phase, might bypass Raydium altogether. Instead of setting up shop on Raydium, they might just stay within the pump.fun ecosystem. This potential shift has sparked fears of a shrinking trading volume for Raydium, impacting its revenue and token buybacks.

Decoding the RAY Dip: Why the Pump.fun Buzz Matters

Let's break down the Raydium-pump.fun connection for those still catching up.

Pump.fun is the go-to launchpad on Solana for meme tokens right now. Their token launch process has two stages: an "internal" and an "external" phase. Initially, tokens trade in the "internal" market, using pump.fun's own bonding curve mechanism for price discovery. Once trading volume hits $69,000, things move to the "external" phase. This is where the liquidity migrates to Raydium, setting up a pool on the DEX for continued trading.

Now, where does Raydium and its token RAY fit in?

Raydium currently pockets 0.25% from every trade. Out of this, 0.22% goes to the liquidity providers (LPs) who fuel the exchange, and 0.03% is used to buy back and burn RAY tokens, as well as support the ecosystem. In simpler terms, Raydium's trading volume directly influences RAY's price through these fee-based revenues.

So, here's the potential problem: If pump.fun builds its own AMM, the liquidity spigot to Raydium could be turned off. This means less trading volume and fewer fees for Raydium, which in turn could hit RAY's value.

Raydium's Pump.fun Dependence: Just How Deep Does It Go?

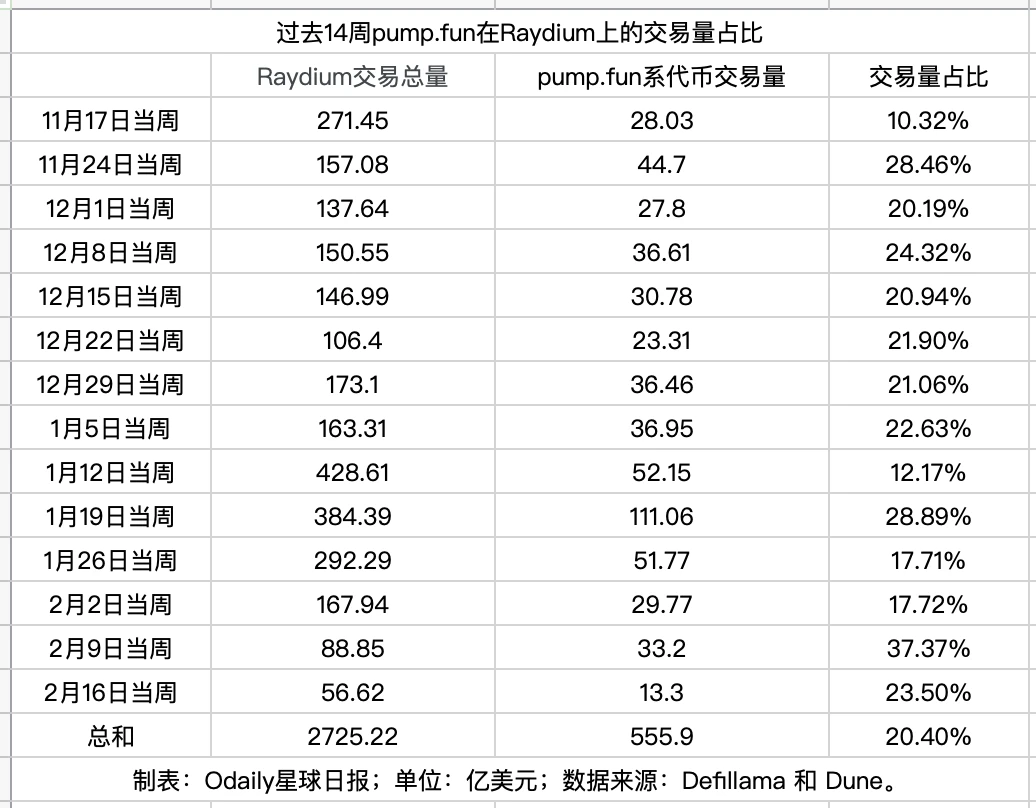

The market's been digesting this Raydium-pump.fun scenario all day, but surprisingly, no one seemed to be crunching the numbers on just how reliant Raydium is on pump.fun's trading volume. So, we dug into data from Defillama and Dune. The snapshot is below.

As you can see, over the past 14 weeks, pump.fun-related tokens have contributed roughly 20% of Raydium's total trading volume. This suggests that if pump.fun does build its own AMM and divert that flow (ignoring potential shifts in liquidity due to platform fees), Raydium could face a 20% haircut in trading volume.

Was the RAY Price Drop an Overreaction?

Zooming back to the market action, RAY on OKX tanked to a low of $2.82 earlier today, a plunge of over 30%! (Hindsight is 20/20, and it does look like a bit of an overshoot now). Currently, it's clawed back some losses, trading around $3.15, still down by 25.43%. Considering Solana (SOL) itself dipped by 5.8%, RAY's current drop seems to be within a reasonable range – it looks like the market has already priced in the potential impact of pump.fun's move.

Let's wrap up with a quote from Fluid COO DMH:

RAY's price crash is another stark reminder that "distribution trumps tech." In both the traditional world (Microsoft) and crypto (Metamask), countless examples show that if you've got the users, your tech takes a backseat in importance.