In the ever-volatile crypto space, a recent tweet from Mr. WHALE has captured the attention of traders and enthusiasts alike. The post shines a spotlight on Satoshi Nakamoto, the pseudonymous creator of Bitcoin, portraying him as the ultimate HODLer – someone who buys and holds assets long-term, regardless of market fluctuations.

The tweet reads: "🫡 He never sold, He will never sell. He’s down $42 Billion, from $133 Billion to $91 Billion, and still hasn’t touched a single Bitcoin. Holders always win. BUY and HODL 💪" You can check out the original tweet here.

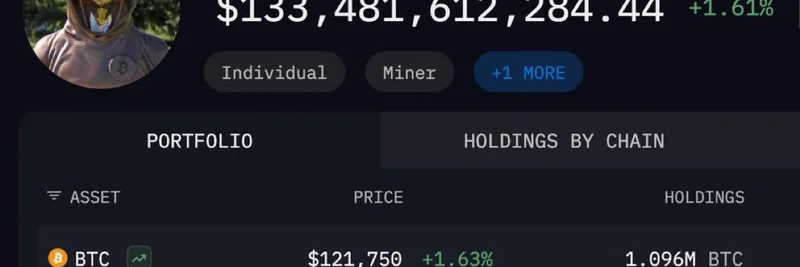

Accompanying the message are two striking screenshots from what appears to be a portfolio tracker, likely from Arkham Intelligence or a similar platform, showing Satoshi's holdings before and after a significant Bitcoin price dip.

This first image captures the portfolio valued at over $133 billion, with Bitcoin priced around $121,750 per coin. Satoshi's holdings? A whopping 1.096 million BTC, untouched.

The second screenshot shows the value plummeting to about $91.5 billion as Bitcoin's price drops to $83,480. Yet, the holding amount remains exactly the same – not a single satoshi (the smallest unit of Bitcoin) has been moved.

Why This Matters in Crypto

For those new to the scene, "HODL" is a meme-born term from a misspelled "hold" in a 2013 forum post, now synonymous with sticking to your investments through ups and downs. Satoshi's dormant wallets embody this perfectly. Despite Bitcoin's price swinging wildly – from pennies at inception to six figures today – these addresses haven't seen outflows in years.

This tweet comes at a time when Bitcoin experienced a sharp correction in November 2025, dropping from highs near $122,000 to around $83,000. While the exact cause isn't specified in the post, such dips are common in crypto, often triggered by macroeconomic factors, regulatory news, or market sentiment shifts.

Lessons for Meme Token Enthusiasts

At Meme Insider, we focus on the fun, fast-paced world of meme tokens – think Dogecoin, Shiba Inu, or the latest viral sensations on Solana or Ethereum. These assets are even more volatile than Bitcoin, with pumps and dumps happening in hours rather than weeks.

Satoshi's story offers timeless advice:

Patience Pays Off: Meme coins can skyrocket overnight but crash just as fast. Holding through the noise, like Satoshi, could mean riding out to bigger gains. Remember, early Dogecoin holders turned small investments into fortunes by not selling too soon.

Ignore the Noise: Social media hype and FOMO (fear of missing out) drive meme token prices. But as the tweet reminds us, "Holders always win." Focus on projects with strong communities or real utility, not just short-term flips.

Risk Management: Satoshi's holdings are diversified in legend only – it's all BTC. For meme traders, spreading bets across a few promising tokens can mimic this steadfast approach without all eggs in one basket.

The replies to the tweet echo community sentiment, with users cheering the HODL mentality or joking about Satoshi's "new hobby." One even speculates on lost wallet access, adding to the mystique.

Applying HODL to Your Meme Portfolio

If you're diving into meme tokens, tools like DexScreener or CoinMarketCap can help track holdings similar to the screenshots shown. Always do your own research (DYOR) – meme coins are high-risk, high-reward.

In a market where paper hands (quick sellers) often lose out, channeling your inner Satoshi could be the edge you need. As Mr. WHALE puts it, BUY and HODL. Who knows? Your favorite meme coin might just become the next Bitcoin.