Solana's Wild Ride: Meme Coins or Real Deal?

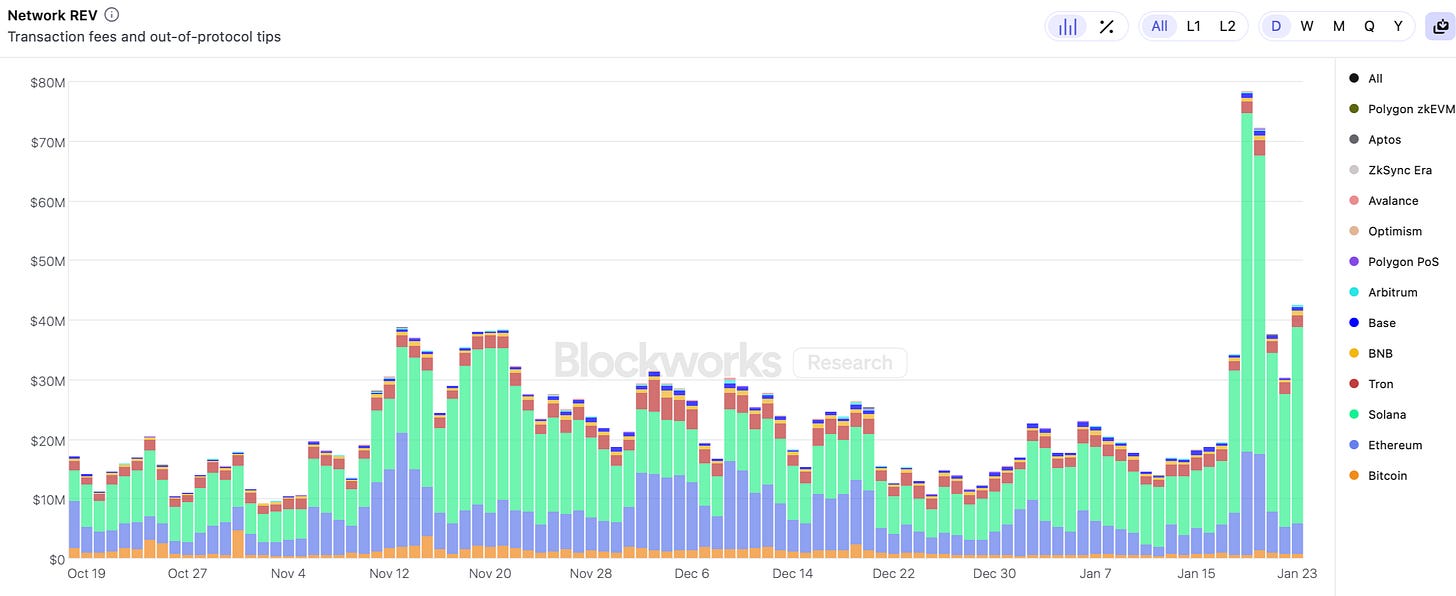

Ever wondered why Solana (SOL) has been going to the moon while Ethereum (ETH) seems to be taking a breather? Some crypto gurus are spinning a tale of Solana as the superior blockchain, boasting about its tech and booming ecosystem. They point to metrics like DEX volume and REV – that's Real Economic Value, basically a measure of the cash flowing through a crypto network.

The story goes like this: Solana's tech is just better, attracting developers and users in droves across all sorts of cool apps. This supposed tech advantage is driving up Solana's REV, making SOL a smart investment based on future earnings, unlike, well, some other cryptos that rely on "vibes."

But hold up! Is this narrative too good to be true? Let's dig a little deeper.

The 10x Pump: Narrative Time!

When you see a crypto like SOL skyrocket 10x against ETH, alarm bells should be ringing. Time for the "narrative factory" to kick in and explain it all away!

The story they're selling? Solana is the place to be. Better tech, happy users, and all the hottest crypto trends – Decentralized Physical Infrastructure Networks (DePIN), DeFi, payments – are flocking to SOL. Oh, and maybe a tiny bit of meme coin action, they might reluctantly admit.

Check out these charts they'll flash:

See? Dominance! Apps galore! Amazing growth! It's a compelling picture, right?

Meme Coins to the Rescue? Or Maybe Not...

But before we crown Solana the king and send Ethereum back to the digital stone age, let's peek under the hood. Where is all this REV actually coming from?

Is it a healthy mix of groundbreaking stuff? Innovative DePIN projects, decentralized exchanges (CLOBs) building the "Decentralized NASDAQ," real-world stablecoin payments, complex DeFi transactions… and maybe a sprinkle of meme coins?

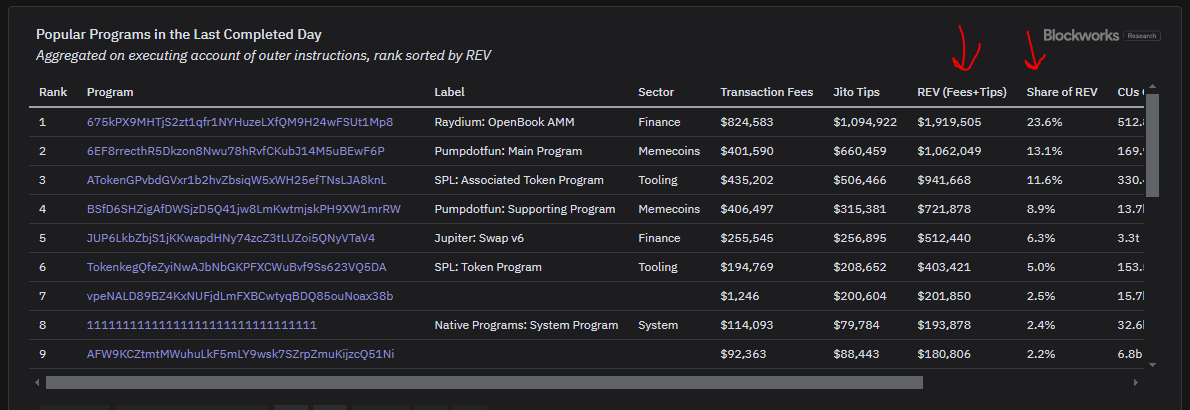

Let's check the data:

Sources of REV on Solana (credit Dan Smith / Blockworks)

Application Fees on Solana (credit Dan Smith / Blockworks)

Wait a minute… is it all Pump.fun and Telegram bots trading meme coins like $BUTTHOLE?

Where are these revolutionary apps we were promised? The DePIN revolution? Global price discovery? Are we just upgrading the blockchain to handle more bots trading joke coins? Anatoly, explain yourself!

The Decentralized Casino Effect

This isn't to say meme coins are evil. They can be fun, bring new people into crypto, and even redistribute wealth (from "uninformed participants" to savvy traders, as they say).

But if Solana's REV is entirely fueled by meme coin trading, that's a shaky foundation for valuing SOL based on future growth.

Let's spin our own narrative: After the FTX crash, Solana was down bad. But it had a story to tell – a plan for scaling and a vibe that resonated with Silicon Valley investors.

As money poured in, the price went up. And in crypto, rising prices are magic. They create a "wealth effect." Think of it like a pressure cooker of cash. The pressure builds, and the easiest release valve? Pumping money into riskier, sillier assets… like meme coins!

So, is Solana's impressive REV a sign of a thriving tech ecosystem, or just a reflection of the meme coin casino running wild? It might be time to question the narrative and dig deeper.