Hey crypto enthusiasts! Ever heard a story that just makes your jaw drop? This one's about to. It all started, believe it or not, with Dogecoin – yes, that very meme coin that sometimes goes to the moon!

The Dogecoin Spark in the COVID Era

Back in January 2021, as the world was navigating the pandemic, a Bloomberg journalist named Zeke Faux got wind of something incredible. A friend of his had thrown just ten bucks into Dogecoin and watched it pump to a sweet $500 profit! This got Zeke thinking, "What's the deal with this crypto stuff?"

He decided to dive deep, focusing on a name you might have heard: Tether. Tether is behind USDT, a "stablecoin" pegged to the US dollar – basically crypto that's supposed to stay steady in value. But here's the kicker: Zeke discovered that Tether was a massive company, holding around $55 billion! That's bank-level big, folks.

What made it even weirder? The guy in charge, Giancarlo Devasini, was no Wall Street whiz. Turns out, his background was in… Italian plastic surgery and electronics importing. And get this, he even had a past brush with accusations of pirating Microsoft software! Crypto is wild, right?

Before his crypto days, Devasini was selling CDs and DVDs after his factory went bust. In a twist of fate, he once offered 20 million CDs/DVDs for Bitcoin on the Bitcointalk forum. Those Bitcoins he got? Today, they'd be worth billions! Talk about turning things around.

Around the same time, Devasini invested in a crypto exchange called Bitfinex. Founded by a young French guy who apparently copied code from another exchange, Bitcoinica, Bitfinex soon had Devasini at the helm. Transparency? Well, back in 2014, Devasini responded to customer concerns on Bitcointalk, stating they were transparent but wouldn't waste time on "meaningless accusations." Hmm, interesting.

Here’s the thing that raised eyebrows: Tether's business model seemed risky. Any profits from investments went straight to Devasini and the shareholders, but losses? They would potentially be footed by the people holding Tether! This meant if Tether's investments went south, they might hide it, leading to a potential bank run – crypto style.

The Swiss Mystery

In the summer of 2021, Zeke decided to track down Devasini at an exhibition in Lugano, Switzerland. Imagine the scene: Zeke waiting at Bar Laura, hoping to catch a glimpse of the crypto tycoon. But 12:38 PM rolled around, and no Devasini. The mystery deepened.

Bigger Plans and Bitcoin Bonds

Fast forward to November 16, 2022, just days after the FTX crypto exchange imploded. Devasini pops up in El Salvador, happily posing with President Nayib Bukele. Turns out, they were cooking up a $1 billion "Bitcoin Bond" plan, also known as "Volcano Bonds." Volcano Bonds? In crypto? You bet!

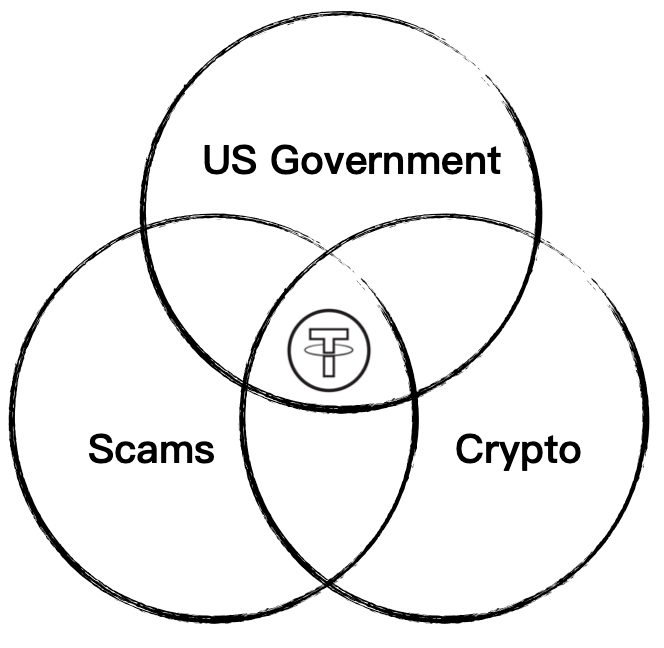

So, what's the big picture here? It seems Tether plays a crucial role in the crypto world and even beyond:

The US Government Angle

Some believe the US government needs to keep the US dollar strong, and Tether, surprisingly, might be helping with that. Tether holds a massive amount of US Treasury bonds – reportedly over $113 billion!

Crypto Market Impact

After the crashes of giants like Binance, FTX, and others, Tether stands out as a major player. Holding Bitcoin equivalent to a huge chunk of US national debt and facilitating crypto transactions, Tether is a game-changer.

International Shenanigans

Stablecoins like Tether are often used for moving money around, sometimes in less-than-legal ways like money laundering or drug trafficking. This creates vulnerabilities in both the US financial system and the crypto markets.

So, What's the Takeaway on Tether?

Let's break it down:

For the US Government

Tether's massive holdings of US debt could be seen as supporting the dollar, whether intentionally or not.

For the Crypto Market

In a volatile crypto world, Tether's stability (or lack thereof if things go wrong) has huge implications. It's a central piece in the crypto puzzle.

For the Shady Side of Things

The ease of moving USDT makes it a tool for illicit activities, which is a problem for regulators and the reputation of crypto.

Making Sense of It All

What does it all mean? Well, Tether's story is a wild ride from meme coin beginnings to potentially reshaping global finance. Whether it's a pillar of the crypto world or a house of cards is still a question many are asking. One thing is for sure: keep your eyes on Tether, because this story is far from over!