Token Terminal, a leading platform for crypto fundamentals, just dropped a game-changer for anyone diving into tokenized assets—including the wild world of meme tokens. In a recent thread on X, they announced the launch of an asset-first data model designed to handle tokenized assets, or RWAs (Real World Assets), at scale. This update means better, standardized metrics for thousands of assets across multiple chains, making it easier for blockchain practitioners to track and analyze their favorites.

Breaking Down the New Model

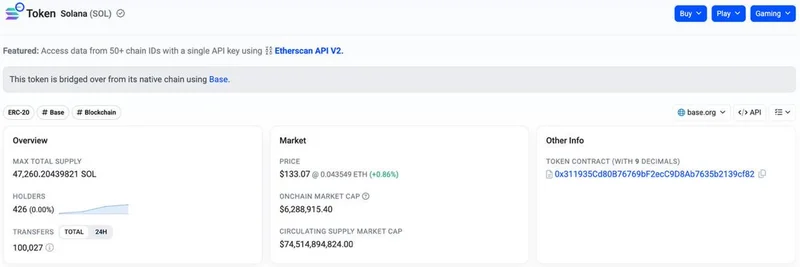

At its core, the asset-first approach shifts focus from projects or issuers to individual assets. For example, it separates metrics for Circle (the project) from USDC (the asset itself). This allows Token Terminal to automatically list and track key onchain metrics using just a token's address and chain.

The model pulls in standardized data like circulating market cap, price, number of holders, transfer volume, transfer count, mints, and redemptions. It's built to keep up with the rapid growth in tokenized assets—think new stablecoins popping up daily, tokenized funds and stocks, DEX liquidity provider (LP) tokens, lending positions, and even DAO governance tokens.

Why This Matters for Meme Tokens

Meme tokens thrive on community hype and viral trends, but solid data can separate the gems from the rugs. Token Terminal already has a dedicated Meme Coins market section, tracking heavy hitters like PEPE, FLOKI, and SHIB with metrics on active addresses, circulating supply, and more. This new model supercharges that by expanding coverage in a standardized way, potentially including more meme-related LP tokens or governance assets from meme DAOs.

With the tokenized assets market exploding—over 1,000 assets from 80+ issuers across 30+ chains—this upgrade ensures meme token enthusiasts can access consistent metrics without chain-hopping headaches. Institutional investors are demanding this level of detail, and now retail players in the meme space can benefit too.

The Bigger Picture: Timing and Impact

Why now? The number of tokenized assets is skyrocketing, driven by innovations in stablecoins, funds, and even tokenized stocks. Add in the constant creation of LP tokens on DEXs and governance tokens from new DAOs, and it's clear why an automated, scalable system is essential.

Token Terminal's in-house data pipeline makes this possible, allowing quick iterations without relying on third-party APIs. For more on their engineering behind the scenes, check out this resource.

Customer feedback from institutions highlights the need for cross-chain, asset-level metrics. This model delivers exactly that, positioning Token Terminal at the forefront of crypto data analytics.

How Meme Insiders Can Leverage This

If you're building or investing in meme tokens, head over to Token Terminal's Tokenized Assets dashboard to explore. It's a treasure trove for spotting trends in holders, transfers, and market caps—key indicators for meme token momentum. Whether you're eyeing the next big pump or analyzing post-launch redemptions, these tools can sharpen your edge in the blockchain space.

Stay tuned as Token Terminal continues to expand coverage. This is just the start for more robust, accessible data in the ever-evolving world of meme tokens and RWAs.