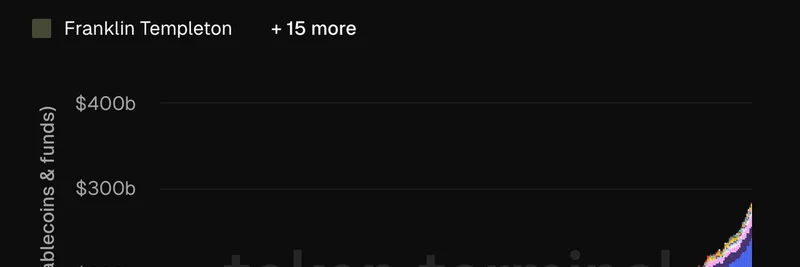

If you've been keeping an eye on the blockchain space, you know that tokenized assets are no longer just a niche experiment—they're becoming a core part of modern finance. A recent post from Token Terminal highlights this shift, showing that the assets under management (AUM) for tokenized stablecoins and funds have hit around $300 billion. That's a massive milestone, and it's not just crypto enthusiasts driving it anymore.

Breaking Down the Chart

The stacked area chart illustrates the evolution over time. Tether (in teal) dominates the early years and still holds the largest share, representing the stability that stablecoins provide by pegging their value to fiat currencies like the US dollar. Circle's USDC (in blue) follows closely, known for its transparency and regulatory compliance.

But the real intrigue comes from the newcomers. BlackRock's entry (in light blue) via their tokenized funds signals Wall Street's serious interest in blockchain tech. Similarly, Franklin Templeton and PayPal are bringing their established reputations to the table, offering tokenized versions of traditional assets. This isn't just about stablecoins anymore; it's funds too, like those from Ondo Finance and First Digital Labs, adding layers to the ecosystem.

The chart also nods to +15 more issuers, hinting at even broader participation. From Sky and Ethena to Ripple and TrueUSD, the diversity shows how tokenized assets are attracting a mix of innovators.

Why This Matters for Blockchain Practitioners

Assets under management, or AUM, is a key metric in finance—it's the total market value of assets that an entity manages on behalf of clients. In the tokenized world, this means blockchain-based representations of real-world assets (RWAs) like currencies, stocks, or even bonds. The surge to $300B underscores blockchain's maturation, making it easier for everyday users and institutions to access liquid, transparent markets without the old gatekeepers.

Token Terminal's caption nails it: crypto-native issuers are still in the lead, but competition from Wall Street is heating up. BlackRock, the world's largest asset manager, isn't dipping its toes—it's diving in. This could mean more liquidity, better yields, and wider adoption for DeFi (decentralized finance) protocols. For meme token enthusiasts, this trend might open doors to new hybrids: imagine meme coins backed by tokenized real assets, blending fun with financial utility.

Dropping the 'Crypto' Label

The post ends with a bold suggestion: "Drop the “crypto”. Just “finance”. It's cleaner." It's a sentiment that's gaining traction as boundaries blur. With regulators warming up and big players joining, what we call "crypto" is evolving into mainstream finance on steroids—faster, more accessible, and powered by blockchain.

If you're building in this space, keep an eye on these developments. Tools like Token Terminal can help you track metrics and stay ahead. For more insights on how this intersects with meme tokens and blockchain tech, stick around on Meme Insider—we're here to decode the trends that matter.