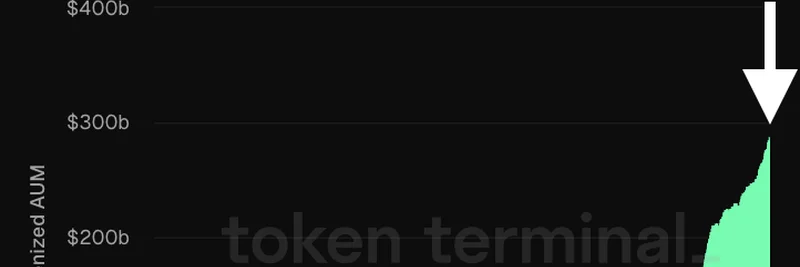

The world of blockchain is buzzing with a major milestone: tokenized assets have skyrocketed to an all-time high of around $290 billion in assets under management (AUM). This isn't just a number—it's a sign that traditional finance is blending seamlessly with crypto, bringing real-world assets like currencies, commodities, treasuries, private credit, equity, and venture capital onto the blockchain.

As highlighted in a recent post from Milk Road, this growth means these assets are now "moving on-chain at scale." For anyone new to the term, tokenization is essentially turning physical or traditional assets into digital tokens on a blockchain. Think of it as digitizing a stock certificate or a bond so it can be traded like cryptocurrency.

Why This Matters for Blockchain Enthusiasts

Every dollar that's tokenized opens up a world of possibilities. Unlike traditional markets that close for the night or weekends, these assets can now trade 24/7. Settlements happen instantly—no more waiting days for funds to clear. And the real game-changer? They plug right into decentralized finance (DeFi) protocols. Imagine earning yield on your tokenized treasuries through lending platforms or using them as collateral in automated trades, all without intermediaries.

This surge isn't happening in a vacuum. The chart from the post shows a steady climb since 2018, with a sharp uptick in recent years. It's driven by big players like BlackRock and other institutions dipping their toes into blockchain, making it easier for everyday investors to access high-quality assets through crypto wallets.

Implications for Meme Tokens and the Broader Ecosystem

While meme tokens thrive on community hype and viral trends, this RWA boom could indirectly boost them too. As more capital flows on-chain, liquidity increases across the board, potentially creating fertile ground for meme projects to integrate real-world utilities. For instance, tokenized funds could back meme-based DAOs or provide stable collateral for volatile tokens, blending fun with fundamentals.

Blockchain practitioners should keep an eye on this trend—it's enhancing the entire ecosystem. Tools and platforms are evolving to handle these assets, from Ethereum layers to specialized chains like those focused on RWAs.

Looking Ahead

With predictions of trillions in tokenized AUM in the coming years, as echoed in community discussions, the line between TradFi and DeFi is blurring fast. If you're building or investing in memes or broader crypto, understanding tokenization is key to staying ahead. Follow sources like Milk Road for daily insights, and dive deeper into how this shift could supercharge your strategies.