In the fast-paced world of crypto, token holder count can be a telling indicator of a project's momentum. It's like watching a meme go viral—sudden spikes often signal growing interest, community buzz, or even the start of something bigger. This week, data from Token Terminal highlights the protocols with the most dramatic weekly upticks in holders. Leading the pack is OpenEden with an eye-popping 83,844.4% increase. Let's break down the list and see what's driving these surges.

Why Token Holder Growth Matters in Crypto

Before diving into the specifics, a quick explainer: Token holders are essentially the people (or wallets) owning a project's cryptocurrency. A rapid increase can point to hype, new listings, airdrops, or real utility drawing in users. For meme token fans, this metric is gold—it's often an early sign of community-driven pumps. Even for more serious DeFi projects, it reflects adoption. Token Terminal, a go-to analytics platform for crypto fundamentals, tracks this data to help investors spot trends early.

The Top 10 Movers: A Closer Look

Here's the rundown of the top protocols based on the latest 7-day changes. I've included brief overviews, what they do, and why they might be buzzing. Data as of early October 2025.

| Rank | Protocol | Token | Holders (Latest) | 7d Change (%) |

|---|---|---|---|---|

| 1 | OpenEden | EDEN | 7.6K | +83,844.4% |

| 2 | Aster | ASTER | 150.4K | +21.4% |

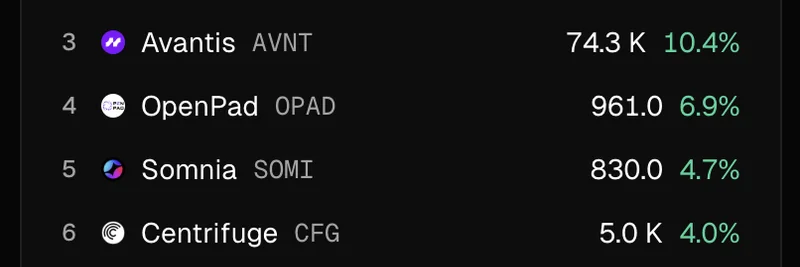

| 3 | Avantis | AVNT | 74.3K | +10.4% |

| 4 | OpenPad | OPAD | 961.0 | +6.9% |

| 5 | Somnia | SOMI | 830.0 | +4.7% |

| 6 | Centrifuge | CFG | 5.0K | +4.0% |

| 7 | Resupply | RSUP | 491.0 | +3.2% |

| 8 | Router Protocol | ROUTE | 2.3K | +3.0% |

| 9 | ApeX Protocol | APEX | 5.2K | +2.8% |

| 10 | RedStone | RED | 9.5K | +2.6% |

1. OpenEden (EDEN): The RWA Giant Awakening

OpenEden is all about bringing real-world assets (RWAs) like US Treasury securities onto the blockchain. Think of it as a bridge between traditional finance and DeFi, allowing anyone to invest in tokenized bonds seamlessly. Their EDEN token powers the ecosystem, and with a whopping 83,844.4% holder surge to 7.6K, it's clear something big is brewing—maybe a major partnership or yield farming incentives. For meme hunters, this kind of explosive growth screams viral potential.

2. Aster (ASTER): Next-Gen DEX for Traders

Aster is a multi-chain decentralized exchange focusing on perpetual contracts and spot trading. It's built for speed and advanced tools, making it a favorite for pro traders. The 21.4% jump to 150.4K holders suggests increasing adoption, perhaps from new listings or features. In a market hungry for efficient trading, Aster's rise could inspire meme-like hype if it catches on with retail crowds.

3. Avantis (AVNT): Leverage on Base

Running on the Base network, Avantis offers leveraged trading for crypto and RWAs with up to 500x leverage—no fees attached. That's a draw for risk-takers. Hitting 74.3K holders with a 10.4% increase, it's gaining traction in the derivatives space. Meme token parallels? High-leverage plays often fuel speculative frenzies.

4. OpenPad (OPAD): AI-Powered Launchpad

OpenPad uses AI to supercharge Web3 investments, offering data-driven launchpads for new projects. It's like a smart incubator for blockchain startups. The 6.9% growth to 961 holders might stem from recent successful launches. For meme enthusiasts, launchpads are where many viral tokens are born.

5. Somnia (SOMI): Blockchain for Gaming and Metaverses

Somnia is an EVM-compatible Layer 1 tailored for real-time apps like games and social platforms. With 830 holders after a 4.7% bump, it's positioning itself in the booming gaming sector. Metaverse projects often overlap with memes, so watch for community-driven narratives here.

6. Centrifuge (CFG): Tokenizing Real Assets

Centrifuge specializes in RWAs, helping businesses access DeFi lending by tokenizing invoices and more. A solid 4.0% increase to 5.0K holders shows steady interest in practical blockchain use cases. Less meme-y, but growth like this builds long-term value.

7. Resupply (RSUP): Stablecoin Innovation

Resupply creates decentralized stablecoins backed by lending positions, enhancing liquidity in markets like Curve and Fraxlend. Up 3.2% to 491 holders, it's a niche player but crucial for stablecoin ecosystems. Stability meets growth—could attract meme-style pumps if volatility hits.

8. Router Protocol (ROUTE): Cross-Chain Mastery

Router enables seamless transfers across 100+ blockchains, acting as a liquidity aggregator. The 3.0% rise to 2.3K holders highlights the demand for chain abstraction. In a fragmented crypto world, this could go viral as interoperability becomes a hot topic.

9. ApeX Protocol (APEX): Decentralized Derivatives

ApeX is a non-custodial DEX for perpetuals and spot swaps, emphasizing security and low fees. With "Ape" in the name, it nods to meme culture, and the 2.8% growth to 5.2K holders fits the bill for community-driven projects.

10. RedStone (RED): Oracle for DeFi

RedStone provides modular data feeds for over 70 blockchains, essential for DeFi apps. A 2.6% increase to 9.5K holders underscores its role in secure on-chain finance. Oracles are backbone tech, but rapid adoption can spark meme-like excitement around reliability.

What This Means for Meme Token Investors

While these aren't pure meme tokens, the holder surges mirror the viral spreads we see in memecoins. Projects like ApeX with cultural ties or OpenEden's insane percentage jump could evolve into meme narratives. Keep an eye on social sentiment—Token Terminal's data is a great starting point, but combine it with X trends for the full picture.

If you're diving into blockchain, these growth stories highlight where the action is. Whether you're in for the tech or the memes, staying informed keeps you ahead. Check out more insights on meme-insider.com for the latest in crypto hype and knowledge.