In the fast-paced world of decentralized finance (DeFi), keeping tabs on platform performance can give traders a real edge—especially when it comes to meme tokens, which often thrive on high-volume, low-fee environments. A recent tweet from Token Terminal caught my eye, highlighting a surprising shift in the DEX arena.

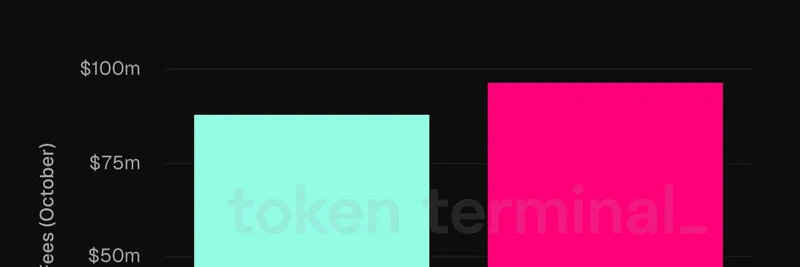

This data, visualized in a straightforward bar chart, shows Uniswap's pink bar towering slightly over Hyperliquid's teal one as of October 25. It's a notable milestone because Hyperliquid, known for its perpetual futures trading (perps), has been gaining traction with its efficient, low-latency setup. Meanwhile, Uniswap, the OG automated market maker (AMM), continues to dominate spot trading, where many meme tokens first gain liquidity.

Why This Matters for Meme Tokens

Meme tokens like Dogecoin derivatives or the latest viral cats and dogs often launch and trade heavily on Uniswap due to its user-friendly interface and vast liquidity pools. Higher fees on Uniswap suggest booming activity—more trades, more swaps, and potentially more hype around emerging memes. If you're a blockchain practitioner hunting for the next big meme, this uptick could signal stronger retail interest in Ethereum-based assets, where Uniswap primarily operates.

On the flip side, Hyperliquid's close second place underscores the rise of specialized DEXes. Built on its own layer-1 blockchain, Hyperliquid excels in perps, allowing traders to bet on price movements without owning the asset. While not as meme-centric, it's a platform where sophisticated traders might hedge their meme positions. The narrowing gap in fees hints at a diversifying market, where meme enthusiasts could explore perps for amplified gains (or losses—always DYOR!).

Broader Implications in the Crypto Ecosystem

This fee comparison isn't just numbers; it's a snapshot of DeFi's evolution. Uniswap's lead might stem from recent upgrades like its V4 version, which introduces more customizable pools and better capital efficiency—key for volatile meme trading. Hyperliquid, backed by impressive tech, is still nipping at its heels, showing that innovation in trading mechanics can challenge established players.

For those building or investing in meme projects, monitoring these metrics via tools like Token Terminal is crucial. It helps gauge where the liquidity—and thus the community—is flowing. As we head into the end of 2025, expect more twists in the DEX wars, potentially fueling the next meme token bull run.

If you're diving into meme tokens, remember: high fees often mean high activity, but always prioritize platforms that align with your trading style. Stay tuned to Meme Insider for more insights on how these trends shape the meme economy.