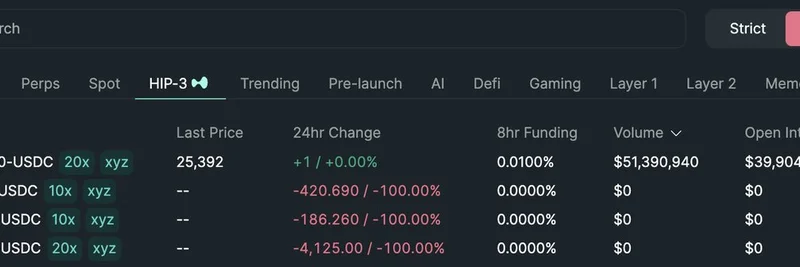

How Spark Exited USDe Before Yields Dropped: Insights for Meme Token Investors

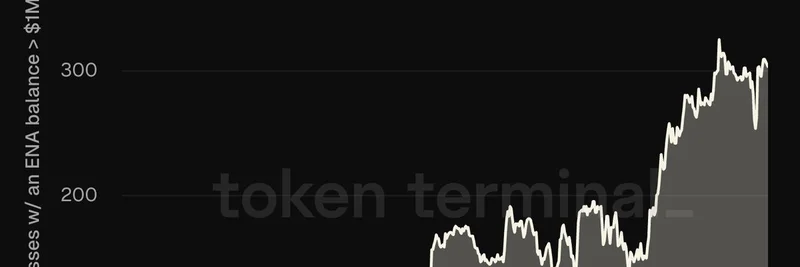

Dive into Sam MacPherson's explanation on why Spark pulled out of Ethena's USDe stablecoin ahead of yield declines, and discover how this DeFi shift could influence meme token strategies in the blockchain space.