In the fast-paced world of crypto, big moves from traditional finance giants always turn heads. Recently, a tweet from crypto commentator MartyParty highlighted a major development: Citadel, the powerhouse hedge fund led by Ken Griffin, has taken a significant stake in DeFi Development Corp (NASDAQ: DFDV), a company that's essentially a public treasury for Solana assets.

提出書類が明らかにしたこと

According to the Schedule 13G filed with the SEC on October 21, 2025, Ken Griffin beneficially owns 1,315,654 shares of DFDV, representing about 4.5% of the company's outstanding shares. This calculation factors in 29,353,143 shares, including some issuable upon warrant conversions held by Citadel affiliates.

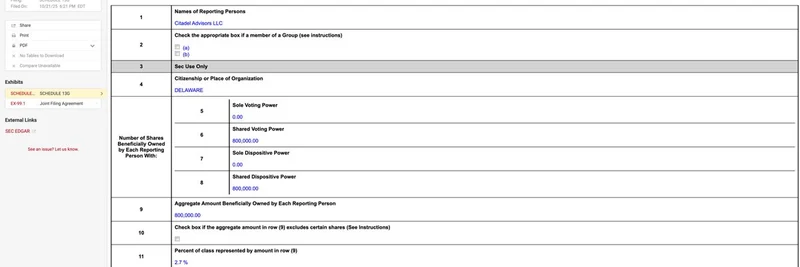

For those new to this, a Schedule 13G is a form that institutional investors must file when they acquire more than 5% of a public company's stock, but in this case, it's under that threshold yet still discloses significant ownership. Citadel Advisors LLC, one of the reporting entities, holds 800,000 shares (2.7%), while other Citadel arms like Citadel Securities add to the total under Griffin's control.

DeFi Development Corp isn't your typical stock—it's the first publicly traded Digital Asset Treasury (DAT) focused on Solana (SOL). Think of it as a vehicle that accumulates SOL tokens, stakes them for yield, and uses DeFi strategies to grow its holdings. Investors in DFDV get exposure to Solana's ecosystem without directly buying crypto, all through a Nasdaq-listed entity.

Solanaとミームトークンにとっての重要性

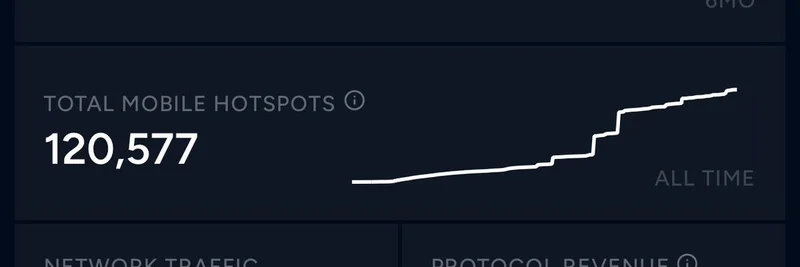

Solana has been a hotbed for meme tokens, from viral hits like Dogwifhat to Bonk, drawing in retail and institutional interest alike. DFDV's model amplifies this by compounding SOL through on-chain activities, recently tapping firms like Gauntlet for advanced strategies on platforms like Drift.

Citadel's entry signals growing confidence from Wall Street in Solana's tech. Ken Griffin, known for his savvy market plays, isn't dipping toes casually—this 4.5% stake could be a bet on Solana's scalability and its thriving meme token scene. With DFDV recently boosting its share buyback program to up to $100 million and acquiring more SOL (over 2 million tokens as of last reports), the company is positioning itself as a key player in bridging traditional finance and blockchain.

ブロックチェーン関係者への示唆

If you're in the crypto space, this is a reminder to watch institutional inflows. Citadel's involvement could pave the way for more hedge funds to explore DATs, potentially stabilizing Solana's price and boosting liquidity for meme projects built on it. For meme token creators, it means bigger eyes on the ecosystem—time to innovate and capture that attention.

Check out DeFi Development Corp's official site for more on their Solana holdings here. And for the full SEC filing details, head over to the EDGAR database.

As the lines between TradFi and DeFi blur, moves like this could accelerate adoption. What's your take—bullish on Solana DATs? Drop your thoughts in the comments below.