If you've been following the crypto space, you know things are heating up. A recent thread from Token Terminal highlights just how far we've come, declaring that "crypto has reached escape velocity." This isn't just hype—it's backed by solid data showing massive adoption and activity across the board. As someone who's covered crypto from the front lines, I can tell you this surge is particularly exciting for meme token enthusiasts. Let's break it down, starting with the eye-popping numbers on onchain lending and how they tie into the wild world of memes.

The Big Picture: Crypto's Meteoric Rise

Token Terminal's thread kicks off with a bold claim: crypto is no longer niche—it's mainstream. Five cryptoassets now boast market caps over $100 billion each, totaling a staggering $3.2 trillion combined. That's not pocket change; it's a sign that people are seriously valuing digital assets.

But value is just the start. Over 1.4 billion unique addresses hold crypto balances today, a 10x jump in four years. This explosion in holders means more people are dipping their toes into the ecosystem, including the playful yet profitable realm of meme tokens. Think about it: memes thrive on community and virality, and with billions of addresses, the potential for meme coin pumps is enormous.

Trading Frenzy on DEXes

Diving deeper, monthly decentralized exchange (DEX) trading volume is flirting with all-time highs at around $500 billion. DEXes like Uniswap and Raydium have become go-to spots for swapping everything from blue-chip tokens to the latest meme sensations. This volume spike since July 2020 shows how accessible trading has become, lowering barriers for anyone to jump into meme token launches or flips.

For meme token traders, this is golden. High liquidity on DEXes means you can buy into a hot new meme like PEPE or DOGE derivatives without massive slippage, and the onchain nature keeps things transparent—no shady centralized exchanges needed.

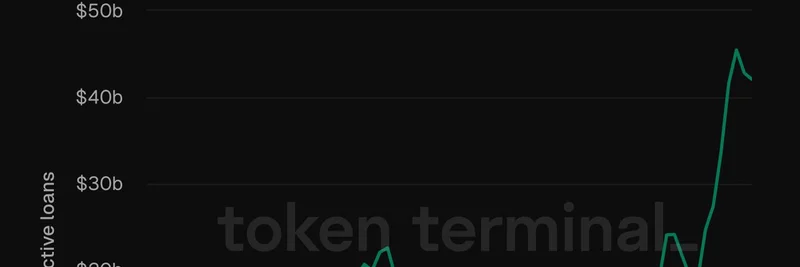

Borrowing Boom: Over $40 Billion in Active Loans

Now, to the heart of the tweet that sparked this article: onchain lending is booming. Over $40 billion is currently borrowed through platforms like Aave and Compound. This figure has been climbing steadily since January 2023, reflecting growing confidence in DeFi lending.

Why does this matter for meme tokens? Lending protocols allow users to borrow against their holdings, often using volatile assets like memes as collateral. Imagine locking up your meme portfolio to borrow stablecoins, then using those to ape into the next big thing. It's leverage in action, amplifying gains (and risks) in the meme space. As lending grows, it provides more fuel for meme-driven speculation, helping sustain those legendary pumps.

User Activity and Stablecoin Surge

The thread doesn't stop there. Global daily active users (DAUs) in crypto are nearing peaks at 27.2 million, up from just 1 million in early 2020. This user boom includes meme communities on platforms like Solana, where low fees make it easy to participate in meme coin airdrops or NFT mints tied to viral tokens.

Stablecoins are another key player, with supply hitting all-time highs of $300 billion—a $100 billion increase this year alone. Stablecoins like USDT and USDC are the lifeblood of meme trading, offering a safe haven to park gains or enter positions without fiat on-ramps. Their growth ensures smooth, borderless transactions for global meme hunters.

Revenue and Low Fees: Building and Using Crypto

Crypto's quarterly revenue is trending up to $4.5 billion since Q4 2022, rewarding builders and protocols. For meme projects, this means more incentives for developers to create engaging, revenue-generating dApps around memes—think staking pools or play-to-earn games with meme themes.

Finally, transaction fees are dirt cheap—under $0.001 on some networks. This removes a major hurdle for mainstream adoption, especially for meme tokens that rely on high-volume, low-value trades. No more getting rekt by gas fees when sniping the next 100x gem.

What This Means for Meme Token Investors

As a hub for meme token insights, Meme Insider sees this data as a green light for the sector. The overall crypto growth—fueled by lending, trading, and user adoption—creates a fertile ground for memes to thrive. Whether you're borrowing to leverage positions or using stablecoins to trade, these trends point to more opportunities in the meme ecosystem.

If you're new to this, start by checking out lending platforms like Aave or DEXes like Uniswap. And for the latest on meme tokens, stick with us at meme-insider.com—we're here to help you navigate the chaos.

Stay tuned for more breakdowns on how macro crypto trends impact your favorite memes. What's your take on this lending surge? Drop a comment below!