In the fast-paced world of cryptocurrency, big players—often called "whales"—can make waves that ripple through the entire market. Recently, the on-chain analytics account Onchain Lens has been spotlighting one such whale, dubbed the "66,000 $ETH Borrowed Whale." This entity has been on a buying spree, snapping up massive amounts of Ethereum (ETH) from Binance while leveraging positions on Aave. Let's break down what's happening, why it matters, and how it ties into the meme token scene.

The Whale's Latest Moves

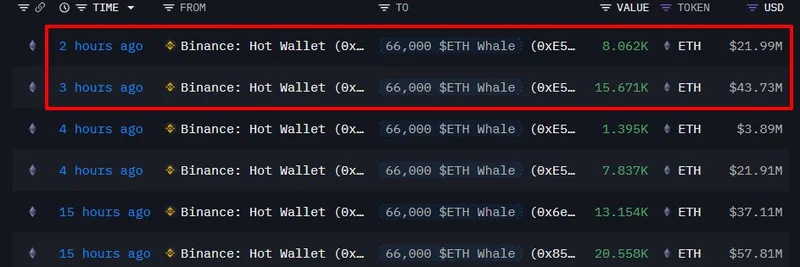

Just hours ago, Onchain Lens reported that this whale scooped up an additional 23,733 ETH, valued at around $65.7 million, directly from Binance. This brings their total purchases in the last 16 hours to a staggering 90,690 ETH, worth about $254.27 million. Currently, the whale holds 465,691 ETH, equating to roughly $1.25 billion.

This update builds on an earlier post from the same day, where the whale had already accumulated 66,957 ETH (about $188.56 million) over 12 hours, holding 441,956 ETH at that point.

A History of Leveraged Accumulation

This isn't a one-off event. Tracking back through Onchain Lens's posts, this whale has been active for over a week, employing a strategy known as "leveraged looping." Here's a simple explanation: The whale supplies ETH as collateral on Aave (a decentralized lending platform), borrows stablecoins like USDT against it, uses those to buy more ETH on Binance, and then supplies the new ETH back to Aave to repeat the process. This amplifies their exposure to ETH's price movements—great if ETH goes up, risky if it drops.

- November 12: The whale borrowed 66,000 ETH initially and bought an additional 30,549 ETH ($105.36 million), holding 385,713 ETH ($1.33 billion).

- November 14 (Early): Added 19,508 ETH ($61.03 million), borrowed $170 million USDT, and hinted at more buys. Holdings reached 405,252 ETH ($1.28 billion).

- November 14 (Later): Bought another 39,658 ETH ($125.09 million), repaid $10 million USDT loan.

- November 15: Started unwinding the position, withdrawing 199,720 ETH ($632.47 million) from Aave and sending 44,000 ETH ($140.24 million) to Binance, facing an estimated $70 million loss.

But the story didn't end there. By November 21, the whale was back in action:

- November 21 (Early): Bought ETH worth $162.77 million from Binance, supplied to Aave. Noted that five days prior (around November 16), they deposited 70,000 ETH ($222.72 million) to Binance. Holdings at 432,718 ETH ($1.23 billion).

This pattern suggests the whale is bullish on ETH, willing to leverage up despite previous losses.

Why Track Whale Activity?

Whales like this can influence market sentiment and liquidity. Their large buys on centralized exchanges like Binance might signal confidence in ETH's future price, potentially driving up spot prices. On-chain tools like DeBank (check the whale's profile here) make it possible for anyone to monitor these moves in real-time.

For blockchain practitioners, understanding these strategies highlights the power of DeFi protocols like Aave for leveraged trading without traditional brokers.

Implications for Meme Tokens

At Meme Insider, we focus on meme tokens, many of which live on the Ethereum network. ETH is the gas that powers these—transaction fees, liquidity pools, and more. When a whale accumulates ETH aggressively, it could stabilize or pump ETH's price, creating fertile ground for meme coin launches and trades.

Conversely, if ETH volatility spikes due to leveraged positions unwinding (as seen on November 15), meme tokens can suffer from higher fees and liquidations. Keep an eye on this whale; their actions might foreshadow broader market trends affecting favorites like PEPE, SHIB, or emerging memes.

Stay tuned to Onchain Lens for updates, and follow us at Meme Insider for more insights on how on-chain events shape the meme economy. What do you think this whale is betting on? Share your thoughts in the comments!