In the fast-paced world of cryptocurrency, big players—often called "whales" because of their massive holdings—can make waves with a single move. Recently, Onchain Lens, a popular account that breaks down blockchain data into digestible insights, spotlighted one such whale's activity in their tweet. This Ethereum holder deposited 1,962 ETH, valued at around $9.38 million, into the OKX exchange. According to the post, this came after holding the ETH for over 11 years, pocketing a tidy $4.7 million profit. But let's dig deeper into the on-chain details to see what's really going on.

取引の内訳

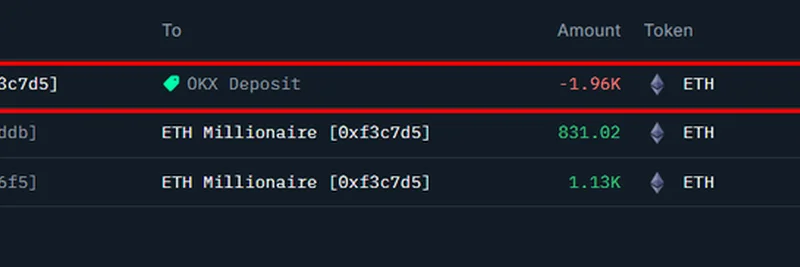

The wallet in question, labeled as "ETH Millionaire" with the address 0xf3c7D5b83DCf6F297E4B1f5A525C1a3eE45D5585, shows some interesting activity. From the screenshot shared in the tweet, we can see:

- A recent outgoing transfer of about 1,962 ETH to an OKX deposit address, worth $9.38 million at the time.

- Incoming transfers from Binance wallets: 831 ETH (valued at $2.04 million) 317 days ago and 1,130 ETH (valued at $2.73 million) 318 days ago.

These inflows total roughly the same amount deposited, suggesting the whale accumulated this ETH around 11 months ago—not 11 years, as the tweet states. Ethereum itself launched in 2015, making an 11-year hold impossible since we're only at the 10-year mark in 2025. It's likely a simple typo in the original post, confusing months with years. One reply to the tweet even questions, "11 years?" highlighting the mix-up.

利益の計算

Whales like this often buy low and sell high, and this case is no exception. Based on the values in the transactions:

- The 831 ETH was received when ETH was trading around $2,456 per coin.

- The 1,130 ETH came in at about $2,416 per coin.

- Total cost basis: Approximately $4.77 million.

Fast-forward to the deposit, with ETH priced around $4,780, turning that stack into $9.38 million. Subtract the initial investment, and you've got a profit of about $4.61 million—close enough to the $4.7 million mentioned, accounting for minor fluctuations or fees.

This kind of move isn't uncommon in crypto. Whales often shift assets to exchanges like OKX for liquidity, potentially to cash out, trade into other tokens, or even dive into meme coins, which can be highly volatile and influenced by market sentiment.

なぜこれは暗号通貨ファンに重要か

On-chain analysis tools, like those used by Onchain Lens, pull data directly from the blockchain—think of it as a public ledger where every transaction is recorded transparently. Tracking whale movements can give clues about market trends. A big deposit to an exchange might signal selling pressure, which could ripple into broader crypto prices, including meme tokens that thrive on hype and momentum.

For blockchain practitioners and meme token fans, stories like this underscore the importance of monitoring on-chain data. It helps spot opportunities or risks early. If you're into meme coins, remember that whale actions in major assets like ETH can indirectly affect smaller, more speculative markets by shifting overall liquidity and investor confidence.

If you're curious, head over to Etherscan to explore the address yourself. Tools like this make the blockchain accessible to everyone, not just the pros.

Stay tuned to Meme Insider for more breakdowns on crypto movements that could impact your favorite meme tokens. What's your take on this whale's play—smart timing or just luck?