If you've been keeping an eye on the crypto space, you know that prediction markets like Polymarket often give us a sneak peek into what traders really think about big economic events. Today, we're diving into some fresh buzz from a tweet by Degenerate News that highlights surging odds on a U.S. Federal Reserve interest rate cut.

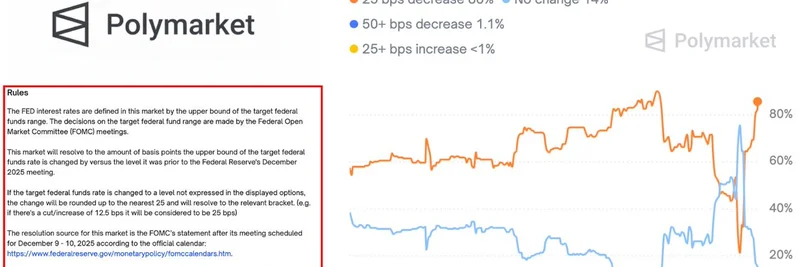

The tweet, posted on November 25, 2025, announces: "NEW: ODDS OF U.S. FEDERAL RESERVE CUTTING RATES BY 25 BPS IN DECEMBER SURPASS 85% ON @Polymarket." For those new to the lingo, "BPS" stands for basis points—a fancy way of saying 0.01%. So a 25 BPS cut means lowering interest rates by 0.25%. Polymarket is a decentralized platform where people bet on real-world outcomes using crypto, and it's become a go-to for gauging market sentiment.

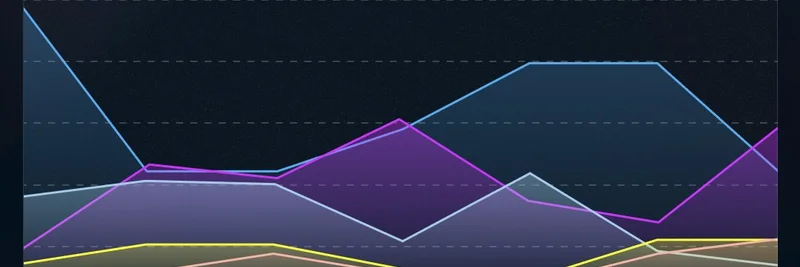

ツイートのチャートを見ると、25ベーシスポイントの引き下げの確率が86%まで上昇しており、据え置きはわずか14%、他のシナリオはほとんど確率が小さいことが分かります。この変化は、トレーダーがインフレの鈍化や他の指標を受けてFRBが経済支援のために利下げを行う可能性にますます自信を持っていることを示唆しています。

Why This Matters for Meme Tokens

Meme tokens thrive on hype, liquidity, and risk appetite—things that often get a boost when interest rates drop. Lower rates mean cheaper borrowing, which can pump more money into speculative assets like crypto. We've seen this play out before: during past rate-cutting cycles, meme coins have gone on wild runs as investors chase high-reward plays.

Think about it—tokens inspired by internet culture, animals, or viral trends don't always follow traditional finance rules. But with easier money flowing, retail traders might flock back in, driving up volumes and prices. If the Fed does cut rates in December, it could signal the start of a broader bull phase for crypto, including favorites like Dogecoin or newer entrants in the meme ecosystem.

Reactions from the Community

The tweet sparked quick reactions on X (formerly Twitter). One user, @SolLunix, chimed in with "Q4 is still bullish 📈🚀," echoing the optimistic vibe. Another, @MrLeoSimpson, pointed out that high odds on a cut might indicate underlying economic weakness, but noted that "crypto is the first place that new money runs." It's a reminder that while rate cuts sound positive, they're often a response to challenges.

Even replies like @crypt0b3ar's "polymarket odds over 85% look pretty locked in" show how much faith the community places in these decentralized predictions. Polymarket has a track record of accuracy, often outperforming traditional polls because real money is on the line.

Looking Ahead

As we head into the end of 2025, keep an eye on the Fed's December meeting. You can check the latest odds directly on Polymarket or follow updates via the original tweet. For meme token enthusiasts, this could be a cue to review your portfolio—rate cuts have historically ignited rallies in volatile assets.

At Meme Insider, we're all about helping you navigate these twists in the blockchain world. Stay tuned for more insights on how macro events like this shape the meme token landscape. If you're betting on outcomes yourself, remember: always do your own research and never risk more than you can afford to lose.