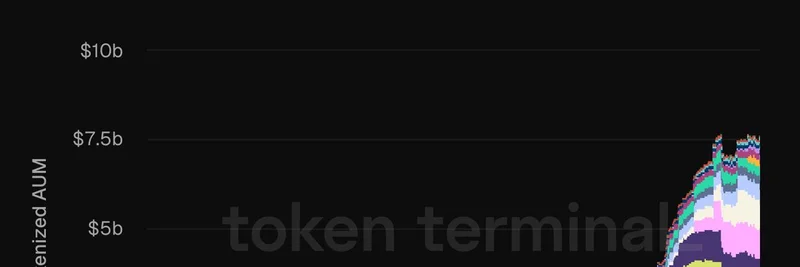

If you've been keeping an eye on the intersection of traditional finance and blockchain, you'll want to check out this recent post from Token Terminal. They shared a fascinating chart breaking down the assets under management (AUM) for tokenized funds by issuer, highlighting how big players are dipping their toes—or in some cases, diving in—into onchain assets.

Understanding Tokenized Funds and AUM

First off, let's break down the basics. Tokenized funds are essentially traditional investment funds—like money market funds or treasuries—that have been digitized and placed on a blockchain. This process, known as tokenization, allows for faster settlements, greater transparency, and easier access via crypto wallets. AUM refers to assets under management, which is the total value of assets handled by these issuers.

The chart from Token Terminal shows a stacked

- 도구는 스레드 내용을 반환했으며, 이미지가 포함된 단일 게시물입니다.

area graph tracking AUM growth from 2023 through 2025. Starting near zero in early 2023, the total AUM has skyrocketed to around $7.5 billion by mid-2025. That's some serious growth, signaling increasing confidence in blockchain for real-world assets (RWA).

Key Players in the Tokenized Funds Space

At the top of the pile is BlackRock, the world's largest asset manager, with its B

🔍 MDX 기사 기획

- 이 기사는 frontmatter에 slug, title, description, cover, tags 등을 포함하여 시작할 것입니다.

UIDL money market fund clocking in at about $2.1 billion in AUM. BUIDL, which stands for BlackRock USD Institutional Digital Liquidity fund, invests in short-term assets like U.S. Treasuries and offers yields through blockchain tech. It's built on Ethereum and has become a benchmark for tokenized treasuries.

Hot on their heels are firms like Ondo Finance, Superstate, and others including WisdomTree, Spiko, Blockchain

- 설명은 "BlackRock이 시장을 지배하는 가운데 발행사별 tokenized funds 성장을 살펴보세요. Token Terminal의 최신 AUM 이전 차트에서 얻은 인사이트."가 될 수 있습니다.

Capital, Franklin Templeton, Fidelity, OpenEden, Midas, Apollo, VanEck, Republic, and Hamilton Lane. Each color in the chart represents a different issuer, stacking up to show their collective impact. For instance, Ondo Finance appears in a light yellow, contributing significantly to the mid-tier growth.

What's interesting is Token Terminal's commentary: "Many big Wall Street firms have tokenized one fund. Few have actually migrated meaningful AUM onchain. So far." This points to a trend where experimentation is rampant, but full-scale adoption is still ramping up. BlackRock's dominance suggests they're leading the charge, but there's room for others to catch up as regulations evolve and tech improves.

Why This Matters for Blockchain Practitioners

For those in the crypto space—whether you're into meme tokens or broader blockchain tech—this trend underscores the blurring lines between TradFi (traditional finance) and DeFi (decentralized finance). Tokenized funds bring institutional money onchain, which could boost liquidity and innovation across the board. Imagine meme token ecosystems benefiting from more stable on-ramps or collateral options backed by these real-world assets.

At Meme Insider, we're all about keeping you ahead in the fast-paced world of meme tokens and blockchain news. Charts like this remind us that while memes drive community and hype, underlying tech like tokenization is what's building the infrastructure for sustainable growth.

Looking Ahead: The Future of Onchain Finance

As we head further into 2025, expect more issuers to migrate larger portions of their AUM onchain. With firms like Fidelity and Franklin Templeton already in the mix, the competition is heating up. If you're a blockchain practitioner, tools like Token Terminal are invaluable for tracking these metrics in real-time.

Stay tuned for more updates on how these developments intersect with meme tokens and the wider crypto landscape. What do you think—will we see $10 billion in tokenized AUM by year's end? Drop your thoughts in the comments!