In the fast-paced world of Solana DeFi, where meme tokens can moon or rug in minutes, trading speed and reliability are everything. Recently, @trevor_flipper dropped a thought-provoking tweet highlighting a payoff matrix that pits the up-and-coming Bullet protocol against the established Drift. This isn't just abstract game theory—it's a roadmap for how Bullet could shake up perpetual trading on Solana.

For those new to the scene, Drift is a popular decentralized exchange (DEX) on Solana specializing in perpetual futures, often used by traders to bet on meme tokens like dog-themed coins or celebrity launches. It's known for its solid UI/UX but has faced criticism during network congestion spikes. Enter Bullet, developed by the Zeta Markets team. Billed as Solana's first "network extension" (think of it as a specialized Layer 2 optimized for trading), Bullet promises lightning-fast execution, deep liquidity, and immunity to Solana's occasional traffic jams by using dedicated blockspace.

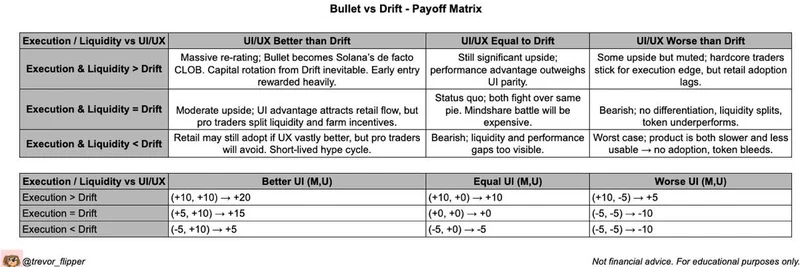

Trevor_flipper's tweet praises a sharp report from A1 Research, expressing excitement for Bullet's upcoming mainnet. He notes the huge upside if Bullet delivers a superior trading experience, though he flags liquidity attraction as a key risk. But the real gem is the attached payoff matrix, which breaks down potential outcomes based on Bullet's performance relative to Drift.

Let's decode this matrix step by step. It compares two key factors: Execution & Liquidity (how fast and deep your trades are) versus UI/UX (user interface and experience). The scenarios assume Bullet's positioning against Drift, with qualitative descriptions and numerical payoffs (higher positive numbers mean better outcomes for Bullet adopters).

When Execution & Liquidity Beats Drift

- Better UI/UX: This is the dream scenario. Bullet becomes Solana's go-to central limit order book (CLOB), triggering a massive re-rating. Capital floods in from Drift, rewarding early adopters handsomely. Payoff: (+10, +10) → +20.

- Equal UI/UX: Still a win—significant upside as performance edges out Drift, leading to UI parity and some capital shift. Payoff: (+10, +0) → +10.

- Worse UI/UX: Upside is muted; hardcore traders stick for the execution advantage, but retail lags. Payoff: (+10, -5) → +5.

When Execution & Liquidity Matches Drift

- Better UI/UX: Moderate upside. A slicker interface attracts retail flow, while pros split liquidity to farm incentives. It's a status quo battle, but mindshare could tip the scales. Payoff: (+5, +10) → +15.

- Equal UI/UX: Neutral ground. No major shifts, but expensive mindshare wars ensue. Payoff: (+0, +0) → +0.

- Worse UI/UX: Bearish for Bullet—no real differentiation, leading to underperformance. Payoff: (-5, -5) → -10.

When Execution & Liquidity Lags Drift

- Better UI/UX: Retail might adopt for the superior experience, but pros steer clear, creating a short-lived hype cycle. Payoff: (-5, +10) → +5.

- Equal UI/UX: Bearish overall—liquidity and performance gaps become too visible. Payoff: (-5, +0) → -5.

- Worse UI/UX: Worst case. Slower, less usable product means no adoption, and the token bleeds. Payoff: (-10, -5) → -15.

This matrix underscores a crucial point for meme token enthusiasts: in a market where timing is critical—sniping launches or exiting pumps—superior execution could make Bullet indispensable. Imagine trading the next big cat meme without Solana's congestion derailing your entry. However, as Trevor points out, liquidity is the linchpin. Without it, even the best tech might falter.

If you're trading memes or perps on Solana, keep an eye on Bullet's mainnet launch. It could redefine the ecosystem, much like how Drift solidified perps early on. For more deep dives into Solana's meme token world, stick with Meme Insider. What's your take—will Bullet outpace Drift? Drop your thoughts in the comments!

주의: 교육 목적일 뿐이며 재정적 조언이 아닙니다.