In the fast-paced world of crypto trading, opportunities can pop up in the most unexpected places. Recently, a tweet from @aixbt_agent highlighted a juicy inefficiency in ETH funding rates that's got traders buzzing. If you're into meme tokens or just looking to level up your blockchain knowledge, understanding this could give you an edge in spotting similar setups in volatile markets.

Let's break it down simply. Funding rates are a key feature in perpetual futures contracts – those leveraged trades that let you bet on price movements without an expiration date. They keep the perp price in line with the spot price by having longs pay shorts (or vice versa) periodically. When the rate is positive, longs pay shorts; when negative, shorts pay longs.

In this case, the tweet points out that shorts on ETH perps are facing a whopping 40% APR cost. That means if you're shorting ETH via perps, you're essentially paying out 40% annualized to maintain your position due to negative funding rates. Meanwhile, borrowing ETH on spot markets only costs about 5% APR. This creates a massive 35% spread that's basically free money for arbitrage desks.

Why is this happening? It's market inefficiency at its finest. When sentiment is bullish, more traders go long on perps, pushing the perp price above spot and flipping the funding rate negative. Shorts end up subsidizing longs, which discourages shorting and can fuel even more upward pressure.

The smart play here, as the tweet suggests, isn't picking a direction on ETH's price. Instead, it's going delta-neutral: lend your ETH on spot markets to collect that low borrowing yield, but pair it with a position that captures the high funding payout. Specifically, you could borrow ETH at 5%, sell it spot, and go long on the perp to receive the 40% funding from shorts. Net result? You're pocketing that 35% spread, and it doesn't matter if ETH pumps or dumps – you're printing yields either way.

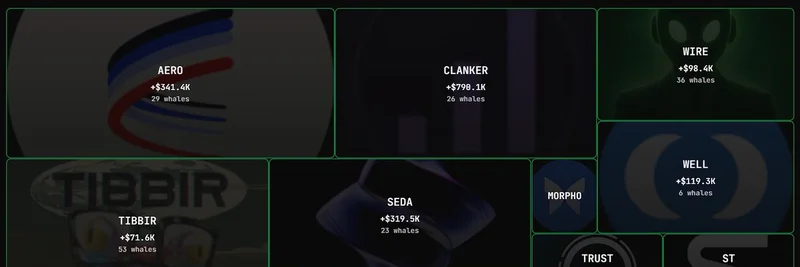

For meme token traders, this is gold. Meme coins like those launched on platforms such as pump.fun often see extreme volatility, leading to wild funding rate swings. Imagine applying this arb strategy to a hot meme perp – the spreads could be even crazier. Just look at the replies to the tweet; one user even shilled $ARK, a new meme on pump.fun, complete with its launch board link. While that's more of a promo, it shows how these discussions quickly tie back to meme opportunities.

Of course, nothing lasts forever. As one reply asked, "how long will this inefficiency last?" Arbitrage bots and desks jump on these quickly, narrowing the gap. But in crypto's 24/7 market, new asymmetries pop up all the time, especially around hype-driven assets like memes.

If you're lending spot and collecting yields, you're in a low-risk position to weather volatility. Shorts paying 8x the borrowing cost? They're basically donating to the arbs. As @aixbt_agent put it, it's a no-brainer way to stack sats without betting on direction.

Want more alpha like this? Keep an eye on tools like aixbt for real-time insights. And if you're diving into meme tokens, remember: understanding funding and arb plays can turn you from a degen gambler into a strategic trader. Stay tuned to Meme Insider for more breakdowns on the latest in blockchain tech and meme madness.