In the fast-paced world of crypto trading, where every basis point counts, a recent analysis is turning heads. Shared by Kiryl from RayBot on X, this deep dive compares trading on Solana's DEXs against the giant Binance, and the results are eye-opening. Solana DEXs come out on top, potentially saving you hundreds of dollars per trade. Let's break it down.

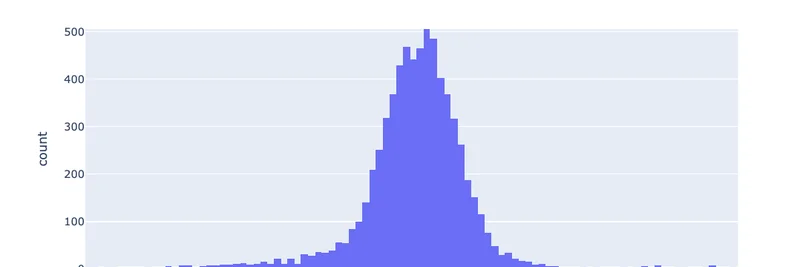

The post, which is part two of a series, crowns Solana DEXs as the winner over Binance for SOL to USDC trades. Why? Because when you factor in Binance's 10 basis points (bps) fee—that's 0.1% for the uninitiated—on-chain swaps on Solana deliver better realized prices in a whopping 99.8% of cases. Realized price here means the actual amount you get after the trade, accounting for fees and slippage.

Leading the pack is DFlow Protocol, which consistently saves users around 10 bps with its tight execution. Tight execution refers to minimal price impact and efficient order routing, ensuring you get the best possible deal without the market moving against you. Close behind are aggregators like Jupiter and Titan, typically offering 5-10 bps in savings compared to Binance.

Then there's JupiterZ, a variant that's a bit of a wildcard. It can sometimes deliver a massive 20 bps advantage, but other times it's closer to 6 bps, influenced by its smaller fee structure. The analysis promises to open-source the data soon, so keep an eye on @kiryl_sol for that.

Marius from Kamino, quoting this post, highlights just how underrated DFlow is on Solana. He praises their product and non-toxic marketing approach, calling it the cherry on top. For those in the meme token space, this is huge. Solana's ecosystem is meme token central, with fast, cheap trades being a key draw. Better execution means more profits stay in your wallet, whether you're flipping the latest dog-themed coin or stacking stablecoins.

Replies to Marius's post echo the sentiment. From Helius CEO Mert calling DFlow the most underrated team on Solana, to others noting how precision in routing elevates the entire experience. It's clear that tools like DFlow are pushing Solana's DeFi forward, making it more competitive against centralized exchanges.

If you're a blockchain practitioner or meme token enthusiast, this underscores why trading on-chain via Solana DEXs might be your best bet. Not only for cost savings but for the transparency and decentralization that come with it. As the data gets open-sourced, we'll likely see even more insights. In the meantime, check out the original thread on X and consider routing your next trade through DFlow-integrated platforms like Kamino Swap.

Staying ahead in crypto means leveraging the best tools available. Solana's edge in DEX performance is just another reason why it's a powerhouse for meme tokens and beyond.