A recent update from Solana Daily on X has the crypto community buzzing: Solana's ecosystem Total Value Locked (TVL) has smashed through to a new all-time high of around $34 billion. That's a whopping 200% jump year-over-year, signaling massive growth and confidence in the Solana network.

This milestone isn't just a number—it's a testament to Solana's rising prominence in the blockchain world, especially for meme token enthusiasts like us at Meme Insider.

What Does TVL Mean for Solana?

If you're dipping your toes into crypto, TVL stands for Total Value Locked. It's basically the total worth of all the assets stashed away in decentralized apps (dApps) on a blockchain. Think of it as a gauge of how much trust and activity is happening on the network. For Solana, this includes everything from stablecoins to staking rewards.

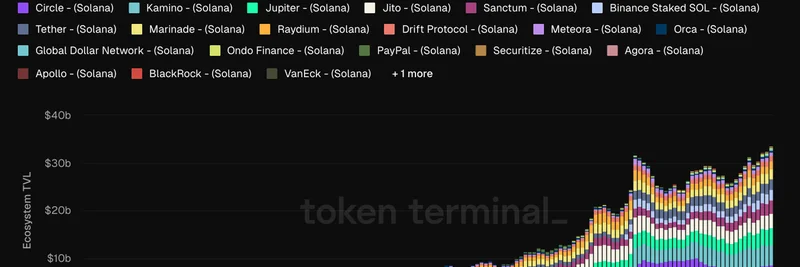

The data, pulled from Token Terminal, shows a colorful stacked chart illustrating the TVL's upward trajectory since early 2023. From near-zero dips to this peak, it's clear Solana is on a roll.

Key Players Driving the Surge

The tweet spotlights the top apps contributing to this TVL boom:

- Circle (Solana): Leading with stablecoin integrations, making it easier to move fiat-like assets on-chain.

- Kamino (Solana): A DeFi protocol focused on automated liquidity strategies.

- Jupiter (Solana): A go-to DEX aggregator for swapping tokens efficiently—super handy for meme coin trades.

- Jito (Solana): Specializing in liquid staking, allowing users to earn rewards while keeping assets liquid.

- Sanctum (Solana): Another staking powerhouse enhancing Solana's proof-of-stake mechanism.

Other heavy hitters include Tether, Marinade, Raydium, and even big names like BlackRock and VanEck, showing institutional interest creeping in.

How This Boosts Meme Tokens on Solana

Solana has earned its rep as the meme coin playground, thanks to low fees, lightning-fast speeds, and platforms like Pump.fun. With TVL skyrocketing, there's more liquidity sloshing around in DeFi protocols. This means better trading conditions for meme tokens—fewer price slips during big buys or sells, and more capital for new launches.

For instance, DEX aggregators like Jupiter (mentioned in a related quoted post) handle billions in volume, directly supporting the wild world of meme trading. Higher TVL often correlates with bull runs in meme coins, as more users flock to the ecosystem for quick flips and community-driven projects.

Broader Implications for Blockchain Practitioners

This growth isn't isolated. Solana's tech edge—handling thousands of transactions per second—positions it as a strong contender against Ethereum. For developers and traders, it means more opportunities to build and engage with innovative dApps. If you're into meme tokens, keeping tabs on Solana's metrics like TVL can give you an edge in spotting the next big trend.

As the blockchain space evolves, milestones like this remind us why Solana remains a favorite for meme insiders. Stay tuned for more updates, and dive deeper into Solana's ecosystem on meme-insider.com.