If you're diving into the world of decentralized finance (DeFi) on Solana, especially with meme coins, liquidity providing can be a goldmine—if you have the right tools. DLMM, or Dynamic Liquidity Market Making, is a feature on platforms like Meteora that lets you provide liquidity in a more flexible way than traditional AMMs. It helps you earn fees while managing risks like impermanent loss (IL), which is basically the potential loss from price changes in your pooled assets.

Recently, a thread from @0xyunss on X highlighted three essential tools that can supercharge your DLMM strategy. These aren't just random picks; they're daily drivers for screening pools, monitoring positions, and tracking profits. Let's break them down, with some tips straight from the thread to help you "print" harder—crypto slang for making solid gains.

Screening and Picking Pools with Fabriq Trade

Starting with the basics: finding the right pools to jump into. Fabriq Trade (formerly SolMeteor) is a go-to for this. It offers a "Meteor Score" that's like a real-time indicator of pool profitability—higher scores mean more fees rolling in.

For quick plays (short-term positions), @0xyunss recommends filtering for:

- Meteor Score: Minimum 500 (or 1000+ for ultra-fast action)

- Minimum FDV (Fully Diluted Value): 300k

- 5-minute LP fees: At least 100

This setup targets high-volatility opportunities, but watch out for big dumps—check the trend charts to avoid traps. For longer holds (multi-hour plays), dial it down:

- Meteor Score: 10-300

- Minimum FDV: 1M (to avoid super-risky low-cap coins)

- 1-hour APR: 0.5%+

Aim for pools with an organic score above 80 and wider ranges to reduce stress. Fabriq's features make it easy to spot these gems without endless scrolling.

Monitoring and Strategy with Clobr

Once you're in, monitoring is key to staying ahead. Clobr shines here with tools like DCA (Dollar-Cost Averaging) pressure analysis, support/resistance levels tailored for liquidity providers (LPers), and live liquidity shifts.

The Clobr Score measures buy/sell wall balance and liquidity thickness near the current price—super useful for predicting moves. But the standout feature? Viewing top wallets in the pool. See their strategies, spreads, and liquidity amounts. It's not about blind copying; use it to validate your own plan or get inspired by the big players. Always DYOR (Do Your Own Research) before diving in.

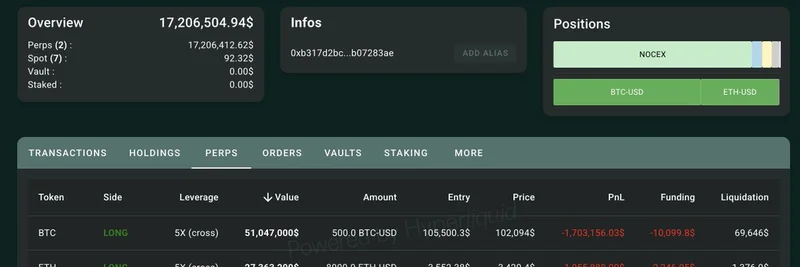

Tracking Profits with LP Agent

No strategy is complete without real-time profit tracking. LP Agent is perfect for this, especially in quick plays where you need to know if fees are beating IL.

It shows claimed/unclaimed fees, uPNL (unrealized Profit and Loss calculated as fees minus IL), and even a PNL calendar for journaling your trades. Get insights like win rates, expected value, and average deployed liquidity over periods like 7 days or a month. Pair it with Clobr to check top wallets' win rates if you're second-guessing your setup. @0xyunss emphasizes: no copy trading, just observation.

Bonus: Custom PNL Tools from MeteoraIDN

As a cherry on top, there's a community tool from MeteoraIDN for generating custom PNL banners. Built by devs like @AlekssRG and @peyekgatel, it lets you hide sensitive info like TVL while creating shareable cards with custom backgrounds. Join their Discord to try it out and flex your gains.

These tools aren't endorsements—using advanced features like wallet connections is at your own risk. For more community resources, check out LP Army's tools list.

In the fast-paced world of Solana DeFi, tools like these can turn liquidity providing from a gamble into a calculated play. Whether you're a newbie or a seasoned LPer, integrating them into your workflow could be the edge you need to outperform the market. Stay safe, manage risks, and happy printing!