In the fast-paced world of crypto, big moves by whales—those large holders who can sway markets—always grab attention. Recently, a tweet from Onchain Lens highlighted a significant withdrawal: a brand-new wallet scooped up 5.01 million $ASTER tokens from Binance, totaling around $7.65 million. If you're into meme tokens or just keeping tabs on blockchain trends, this could signal something bigger brewing in the Aster ecosystem.

Breaking Down the Onchain Activity

Onchain Lens, a popular account for simplifying blockchain data, posted about this transaction on X (formerly Twitter). The wallet in question, with the address 0x832329a4Cca6f5897eeEF925F9a460f2bf463d8E, is freshly created, which often raises eyebrows in the crypto space. Why? Because new wallets pulling large amounts might indicate a whale consolidating holdings away from exchanges, possibly for long-term storage, staking, or even preparing for a big play.

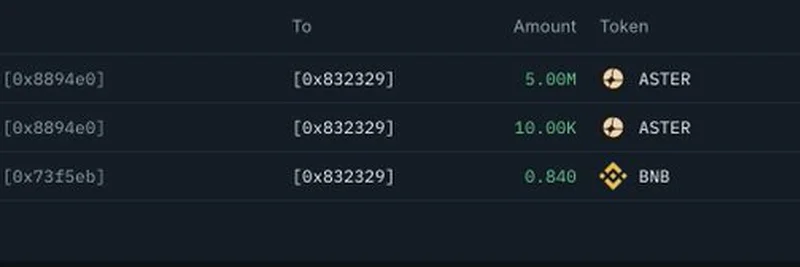

Here's a look at the transaction details shared in the tweet:

From the image, you can see transfers from Binance's hot wallet, including an initial small amount of BNB (likely for gas fees) followed by hefty chunks of $ASTER. This pattern is common for withdrawals: fund the wallet with enough native token to cover costs, then move the main assets.

For those new to this, $ASTER is the native token of Aster DEX, a decentralized platform offering perpetual trading, yield farming, and stablecoin minting. It's not your typical dog-themed meme coin, but in the broader meme token landscape, platforms like Aster enable the creation and trading of viral assets, making whale activities here worth watching.

Community Reactions and Speculation

The tweet didn't go unnoticed, sparking a couple of replies that add flavor to the story. One user, @dandi899, chimed in with "The whale #boycottbinance," accompanied by another screenshot—possibly hinting at broader sentiments against the exchange. Could this withdrawal be part of a larger trend of users moving assets off centralized platforms amid regulatory pressures or trust issues?

Another reply from @marathibitcoin pondered, "No impact on price.... How?" That's a fair question. Withdrawals like this often don't immediately tank prices because they're not sells—they're just shifts in custody. In fact, pulling tokens off exchanges can sometimes be bullish, suggesting the holder is in it for the long haul rather than quick flips.

These reactions underscore how onchain data fuels community discussions, turning raw transactions into narratives that drive engagement in the meme and crypto worlds.

What This Means for $ASTER and Meme Token Enthusiasts

Aster DEX positions itself as a hub for advanced DeFi features, and with a current price around $1.52 (based on recent market data from sites like CoinMarketCap), this whale move represents about 0.5% of the token's total supply—significant enough to monitor but not earth-shattering.

For meme token practitioners, events like this highlight the importance of onchain tracking tools. If you're building or trading memes on platforms like Aster, watching whale wallets can give you an edge: Are they accumulating for a pump? Preparing for liquidity provision? Or just securing assets amid market volatility?

In the meme insider community, we see parallels with how whales influence tokens like DOGE or PEPE. While $ASTER leans more toward utility, its ecosystem could spawn meme-inspired derivatives, making this withdrawal a potential precursor to increased activity.

If you're curious about diving deeper, check out Aster's official X account for updates on airdrops and features. And remember, in crypto, always DYOR—do your own research—before making moves based on whale watches.

Stay tuned to Meme Insider for more breakdowns on onchain events shaping the meme token landscape. What's your take on this withdrawal? Drop a comment below!