In the ever-evolving landscape of Solana's decentralized finance (DeFi) ecosystem, traders are constantly tweaking their strategies to chase the best yields while managing risks. One such trader, @leekuan075, recently shared a follow-up on their approach to lending SOL on Jupiter, offering a glimpse into real-world tactics that blend stability with potential meme token upside.

The Original Plan: A Step-by-Step SOL Strategy

@leekuan075 kicked things off with a clear three-step plan for handling their SOL holdings. For those new to this, SOL is the native token of the Solana blockchain, known for its speed and low fees, making it a favorite in DeFi circles.

Deposit SOL into Jupiter Lend: This involves lending out SOL on Jupiter 的借贷平台, where users can earn interest on their deposits without the complexities of providing liquidity in pools.

Shift to SOL-USDC DLMM at $210: Once SOL's price hits $210 (the level where they previously sold), they'd move into a SOL-USDC Dynamic Liquidity Market Maker (DLMM) pool. DLMM is a sophisticated type of automated market maker on Solana that adjusts liquidity dynamically to reduce risks like impermanent loss—basically, the value erosion that happens in liquidity pools when asset prices fluctuate.

Sell Back and Enter USD1-USDC Pool at $220+: If SOL climbs above $220, the plan is to sell the position back to USDC (a stablecoin pegged to the US dollar) and then provide liquidity in a USD1-USDC pool for more stable yields.

This strategy highlights a balanced approach: starting with low-risk lending and scaling into higher-yield but riskier liquidity provision based on price triggers.

The One-Day Update: Gains, Trade-Offs, and Meme Token Holdings

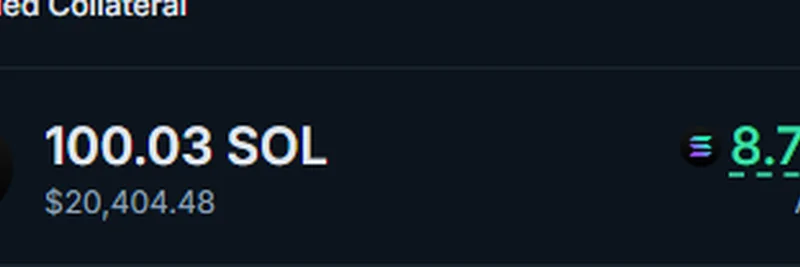

Fast-forward about a day, and @leekuan075 provided an update on how things were panning out. They'd deposited roughly 100 SOL into Jupiter Lend, earning a modest +0.03 SOL in that short period. At the time, this equated to an APY (annual percentage yield) around 8.7%, as shown in the snapshot below.

The Upsides and Downsides:

- The Good: No Impermanent Loss (IL): Unlike liquidity pools, straight lending on Jupiter avoids IL entirely, making it a safer bet for holding through volatile periods.

- The Bad: Lower Yields Than DLMM: While secure, the returns are tamer compared to what a SOL-USDC DLMM pool might offer, especially in a bullish market.

They also mentioned staying invested in two popular Solana meme tokens: $TOKABU and $GOAT. Meme tokens like these often ride waves of community hype and can deliver outsized gains (or losses) in the crypto space. TOKABU and GOAT have been buzzing in Solana's meme coin scene, with communities driving narratives around fun, cultural, or whimsical themes—perfect for those frontrunning trends on the left curve, as @leekuan