In the wild world of crypto, where meme tokens can skyrocket or plummet in minutes, stablecoins like USDe from Ethena are supposed to be the safe harbor. But over the weekend, a massive market crash—the biggest liquidation event in crypto history—sparked rumors that USDe had depegged dramatically on Binance, dropping as low as 68 cents. If you're trading meme coins, this kind of news can send shockwaves through your portfolio. Let's dive into what really happened, based on insights from Haseeb Qureshi's recent thread on X, and why it matters for meme token enthusiasts.

Understanding the USDe "Depeg" Drama

First off, what's USDe? It's Ethena's synthetic dollar, designed to maintain a $1 peg through a mix of hedging strategies and collateral. Unlike traditional stablecoins like USDC, which are backed by fiat reserves, USDe uses more complex DeFi mechanics. During the chaos, charts from Binance showed USDe wicked down hard, leading many to cry "depeg!"

But Haseeb, managing partner at Dragonfly Capital (and full disclosure, an investor in Ethena), argues this wasn't a true depeg. He points out that USDe's primary liquidity isn't on centralized exchanges like Binance—it's on Curve, a DeFi platform with hundreds of millions in standing liquidity. On Curve, USDe barely budged, dipping just 0.3%.

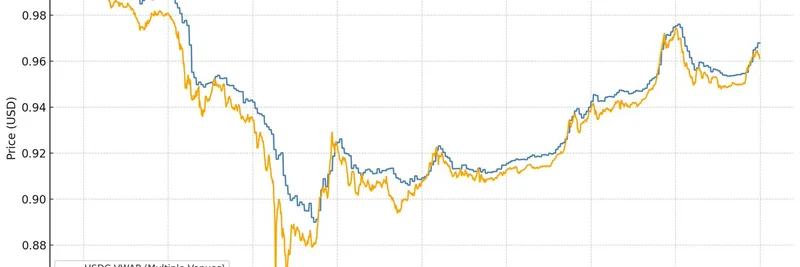

To illustrate, here's a superimposed chart of USDe prices across venues:

While Binance saw a deep dive, Bybit only hit $0.95 briefly before recovering. Curve stayed rock solid. Why the discrepancy? The crash overwhelmed exchanges—APIs failed, withdrawals halted, and market makers couldn't shift inventory. It was like a fire on Binance with no firefighters able to get in.

Binance-Specific Issues: Oracles and Market Structure

Digging deeper, Haseeb highlights two key problems on Binance's end. First, unlike Bybit, Binance lacks a primary dealer relationship with Ethena for on-platform minting and redeeming. This means arbitrageurs had to withdraw funds, arb elsewhere, and redeposit—impossible during the API meltdown.

Second, Binance's oracle (the price feed for liquidations) was poorly set up. It relied solely on its own order book instead of checking primary venues like Curve. This triggered unnecessary liquidations, cascading the price drop. Binance is even refunding affected users, acknowledging the mess-up. Meanwhile, other exchanges aren't, as they handled it better.

For context, recall the real USDC depeg during the 2023 SVB banking crisis:

USDC traded below peg everywhere, with redemptions halted—that's a genuine depeg. USDe? Fully collateralized at $1 on Curve, even increasing backing during the turmoil.

This all stems from a quoted post by Ethena's founder, Guy Young, sharing oracle design tips to prevent such issues:

What This Means for Meme Token Traders

Meme tokens thrive on hype, volatility, and quick trades, often paired against stablecoins on exchanges like Binance. A perceived depeg can trigger panic sells, liquidations, and missed opportunities. If you're holding positions in dog-themed coins or viral pumps, unstable stables amplify risks—your collateral could evaporate in a flash crash.

Key takeaways:

- Diversify Venues: Don't rely solely on one exchange. Check DeFi pools like Curve for true prices during crises.

- Understand Oracles: Poor oracle design can lead to unfair liquidations. Push for better integrations in your favorite platforms.

- Stay Informed: Events like this highlight DeFi's resilience over CeFi in liquidity crunches. For meme traders, it means scouting robust stables to hedge bets.

- Risk Management: Use this as a reminder to set stops, diversify collaterals, and avoid over-leveraging in meme plays.

Ethena's team is pushing for better practices across exchanges, which could make the ecosystem safer for everyone. As Haseeb notes, these shake-ups expose weaknesses and drive improvements—ultimately good for blockchain practitioners chasing the next big meme wave.

If you're deep into meme tokens, keep an eye on stablecoin stability; it's the foundation of your trades. For more insights on how crypto events impact meme markets, stick with Meme Insider.