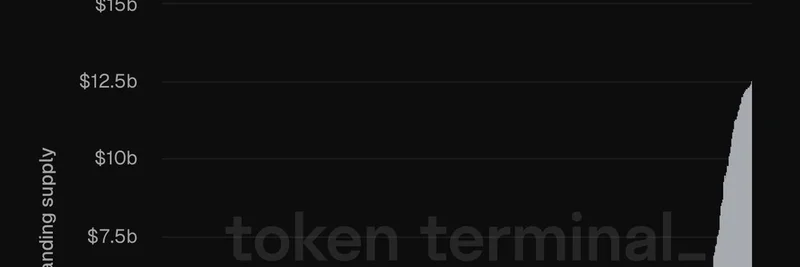

In the fast-paced world of decentralized finance (DeFi), milestones like this don't come every day. According to a recent post from Token Terminal, Ethena Labs' USDe—a synthetic stablecoin—has just crossed the $12 billion mark in outstanding supply on the Ethereum blockchain. What's even more impressive? This supply has more than doubled over the past two months alone.

For those new to the scene, USDe is Ethena's flagship product, designed as a dollar-denominated stablecoin that's backed by a mix of staked Ethereum and hedging positions rather than traditional fiat reserves. This innovative approach allows it to generate yield for holders while maintaining stability, making it a go-to choice for DeFi enthusiasts looking to earn passive income without the volatility of other cryptos.

Why This Growth Matters

This rapid expansion highlights the growing adoption of synthetic assets in the blockchain space. Ethereum, as the leading smart contract platform, continues to host major DeFi protocols, and USDe's surge underscores confidence in Ethena's model. In a market where meme tokens often steal the spotlight with their viral hype, stablecoins like USDe provide the essential liquidity and stability that enable traders to dive into those high-risk, high-reward plays without constant fear of market crashes.

Think about it: with more USDe in circulation, there's greater liquidity for perpetual futures, yield farming, and even meme token trading pairs on decentralized exchanges (DEXs). Platforms like Ethena Labs are pushing the boundaries of what's possible in crypto, blending traditional finance concepts with blockchain efficiency.

Breaking Down the Numbers

Looking at the chart shared by Token Terminal, USDe's supply started modestly in early 2024 but began a steady climb, accelerating sharply from mid-2025. By July 2025, it had reached around $12.5 billion—a clear sign of momentum. This isn't just organic growth; it's fueled by strategic partnerships, integrations with major DeFi apps, and the allure of competitive yields in a low-interest traditional finance environment.

For blockchain practitioners, this is a reminder to keep an eye on metrics like total value locked (TVL) and supply dynamics. Tools like Token Terminal offer real-time data to track these trends, helping you stay ahead in the meme and DeFi game.

Implications for Meme Tokens

At Meme Insider, we focus on the wild world of meme coins, but stablecoins like USDe are the unsung heroes. They act as a safe haven during volatility spikes, allowing meme traders to park funds and earn yields. As USDe expands, it could mean more robust trading ecosystems for popular memes on Ethereum-based DEXs, potentially leading to bigger pumps and more sustainable communities.

If you're diving into meme tokens, consider how stablecoin integrations can enhance your strategy. Whether it's providing liquidity pools or hedging against downturns, USDe's growth is a positive signal for the broader crypto landscape.

Stay tuned for more updates on DeFi innovations and how they intersect with the meme token frenzy. What's your take on USDe's rise? Drop a comment below!